Page 126 - ELT_1st August 2020_Vol 373_Part 3

P. 126

308 EXCISE LAW TIMES [ Vol. 373

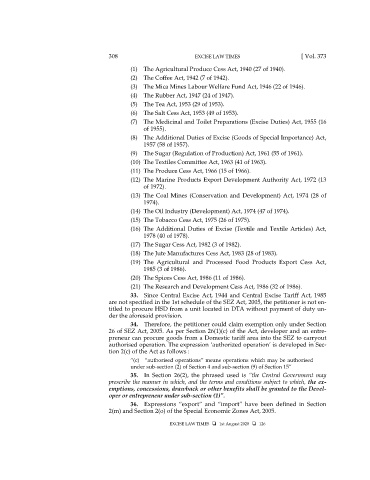

(1) The Agricultural Produce Cess Act, 1940 (27 of 1940).

(2) The Coffee Act, 1942 (7 of 1942).

(3) The Mica Mines Labour Welfare Fund Act, 1946 (22 of 1946).

(4) The Rubber Act, 1947 (24 of 1947).

(5) The Tea Act, 1953 (29 of 1953).

(6) The Salt Cess Act, 1953 (49 of 1953).

(7) The Medicinal and Toilet Preparations (Excise Duties) Act, 1955 (16

of 1955).

(8) The Additional Duties of Excise (Goods of Special Importance) Act,

1957 (58 of 1957).

(9) The Sugar (Regulation of Production) Act, 1961 (55 of 1961).

(10) The Textiles Committee Act, 1963 (41 of 1963).

(11) The Produce Cess Act, 1966 (15 of 1966).

(12) The Marine Products Export Development Authority Act, 1972 (13

of 1972).

(13) The Coal Mines (Conservation and Development) Act, 1974 (28 of

1974).

(14) The Oil Industry (Development) Act, 1974 (47 of 1974).

(15) The Tobacco Cess Act, 1975 (26 of 1975).

(16) The Additional Duties of Excise (Textile and Textile Articles) Act,

1978 (40 of 1978).

(17) The Sugar Cess Act, 1982 (3 of 1982).

(18) The Jute Manufactures Cess Act, 1983 (28 of 1983).

(19) The Agricultural and Processed Food Products Export Cess Act,

1985 (3 of 1986).

(20) The Spices Cess Act, 1986 (11 of 1986).

(21) The Research and Development Cess Act, 1986 (32 of 1986).

33. Since Central Excise Act, 1944 and Central Excise Tariff Act, 1985

are not specified in the 1st schedule of the SEZ Act, 2005, the petitioner is not en-

titled to procure HSD from a unit located in DTA without payment of duty un-

der the aforesaid provision.

34. Therefore, the petitioner could claim exemption only under Section

26 of SEZ Act, 2005. As per Section 26(1)(c) of the Act, developer and an entre-

preneur can procure goods from a Domestic tariff area into the SEZ to carryout

authorised operation. The expression ‘authorized operation’ is developed in Sec-

tion 2(c) of the Act as follows :

“(c) “authorised operations” means operations which may be authorised

under sub-section (2) of Section 4 and sub-section (9) of Section 15”

35. In Section 26(2), the phrased used is “the Central Government may

prescribe the manner in which, and the terms and conditions subject to which, the ex-

emptions, concessions, drawback or other benefits shall be granted to the Devel-

oper or entrepreneur under sub-section (1)”.

36. Expressions “export” and “import” have been defined in Section

2(m) and Section 2(o) of the Special Economic Zones Act, 2005.

EXCISE LAW TIMES 1st August 2020 126