Page 127 - ELT_1st August 2020_Vol 373_Part 3

P. 127

2020 ] DLF UTILITIES LTD. v. UNION OF INDIA 309

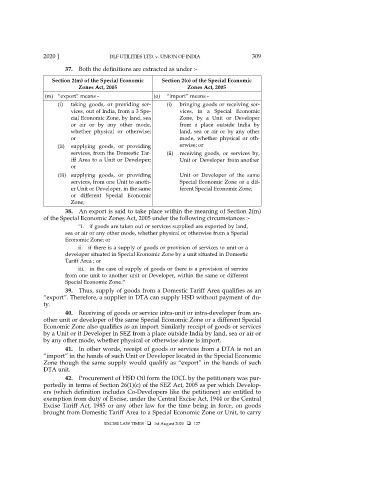

37. Both the definitions are extracted as under :-

Section 2(m) of the Special Economic Section 2(o) of the Special Economic

Zones Act, 2005 Zones Act, 2005

(m) “export” means - (o) “import” means -

(i) taking goods, or providing ser- (i) bringing goods or receiving ser-

vices, out of India, from a 3 Spe- vices, in a Special Economic

cial Economic Zone, by land, sea Zone, by a Unit or Developer

or air or by any other mode, from a place outside India by

whether physical or otherwise; land, sea or air or by any other

or mode, whether physical or oth-

(ii) supplying goods, or providing erwise; or

services, from the Domestic Tar- (ii) receiving goods, or services by,

iff Area to a Unit or Developer; Unit or Developer from another

or

(iii) supplying goods, or providing Unit or Developer of the same

services, from one Unit to anoth- Special Economic Zone or a dif-

er Unit or Developer, in the same ferent Special Economic Zone;

or different Special Economic

Zone;

38. An export is said to take place within the meaning of Section 2(m)

of the Special Economic Zones Act, 2005 under the following circumstances :-

“i. if goods are taken out or services supplied are exported by land,

sea or air or any other mode, whether physical or otherwise from a Special

Economic Zone; or

ii. if there is a supply of goods or provision of services to unit or a

developer situated in Special Economic Zone by a unit situated in Domestic

Tariff Area ; or

iii. in the case of supply of goods or there is a provision of service

from one unit to another unit or Developer, within the same or different

Special Economic Zone.”

39. Thus, supply of goods from a Domestic Tariff Area qualifies as an

“export”. Therefore, a supplier in DTA can supply HSD without payment of du-

ty.

40. Receiving of goods or service intra-unit or intra-developer from an-

other unit or developer of the same Special Economic Zone or a different Special

Economic Zone also qualifies as an import. Similarly receipt of goods or services

by a Unit or it Developer in SEZ from a place outside India by land, sea or air or

by any other mode, whether physical or otherwise alone is import.

41. In other words, receipt of goods or services from a DTA is not an

“import” in the hands of such Unit or Developer located in the Special Economic

Zone though the same supply would qualify as “export” in the hands of such

DTA unit.

42. Procurement of HSD Oil form the IOCL by the petitioners was pur-

portedly in terms of Section 26(1)(c) of the SEZ Act, 2005 as per which Develop-

ers (which definition includes Co-Developers like the petitioner) are entitled to

exemption from duty of Excise, under the Central Excise Act, 1944 or the Central

Excise Tariff Act, 1985 or any other law for the time being in force, on goods

brought from Domestic Tariff Area to a Special Economic Zone or Unit, to carry

EXCISE LAW TIMES 1st August 2020 127