Page 152 - ELT_15th August 2020_Vol 373_Part 4

P. 152

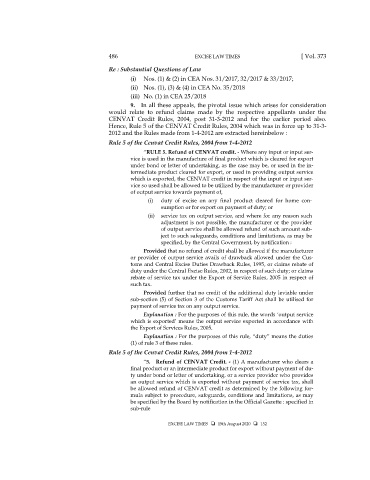

486 EXCISE LAW TIMES [ Vol. 373

Re : Substantial Questions of Law

(i) Nos. (1) & (2) in CEA Nos. 31/2017, 32/2017 & 33/2017;

(ii) Nos. (1), (3) & (4) in CEA No. 35/2018

(iii) No. (1) in CEA 25/2018

9. In all these appeals, the pivotal issue which arises for consideration

would relate to refund claims made by the respective appellants under the

CENVAT Credit Rules, 2004, post 31-3-2012 and for the earlier period also.

Hence, Rule 5 of the CENVAT Credit Rules, 2004 which was in force up to 31-3-

2012 and the Rules made from 1-4-2012 are extracted hereinbelow :

Rule 5 of the Cenvat Credit Rules, 2004 from 1-4-2012

“RULE 5. Refund of CENVAT credit. - Where any input or input ser-

vice is used in the manufacture of final product which is cleared for export

under bond or letter of undertaking, as the case may be, or used in the in-

termediate product cleared for export, or used in providing output service

which is exported, the CENVAT credit in respect of the input or input ser-

vice so used shall be allowed to be utilized by the manufacturer or provider

of output service towards payment of,

(i) duty of excise on any final product cleared for home con-

sumption or for export on payment of duty; or

(ii) service tax on output service, and where for any reason such

adjustment is not possible, the manufacturer or the provider

of output service shall be allowed refund of such amount sub-

ject to such safeguards, conditions and limitations, as may be

specified, by the Central Government, by notification :

Provided that no refund of credit shall be allowed if the manufacturer

or provider of output service avails of drawback allowed under the Cus-

toms and Central Excise Duties Drawback Rules, 1995, or claims rebate of

duty under the Central Excise Rules, 2002, in respect of such duty; or claims

rebate of service tax under the Export of Service Rules, 2005 in respect of

such tax.

Provided further that no credit of the additional duty leviable under

sub-section (5) of Section 3 of the Customs Tariff Act shall be utilised for

payment of service tax on any output service.

Explanation : For the purposes of this rule, the words ‘output service

which is exported’ means the output service exported in accordance with

the Export of Services Rules, 2005.

Explanation : For the purposes of this rule, “duty” means the duties

(1) of rule 3 of these rules.

Rule 5 of the Cenvat Credit Rules, 2004 from 1-4-2012

“5. Refund of CENVAT Credit. - (1) A manufacturer who clears a

final product or an intermediate product for export without payment of du-

ty under bond or letter of undertaking, or a service provider who provides

an output service which is exported without payment of service tax, shall

be allowed refund of CENVAT credit as determined by the following for-

mula subject to procedure, safeguards, conditions and limitations, as may

be specified by the Board by notification in the Official Gazette : specified in

sub-rule

EXCISE LAW TIMES 15th August 2020 152