Page 174 - ELT_15th August 2020_Vol 373_Part 4

P. 174

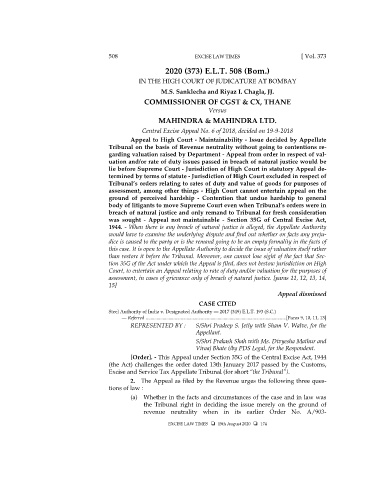

508 EXCISE LAW TIMES [ Vol. 373

2020 (373) E.L.T. 508 (Bom.)

IN THE HIGH COURT OF JUDICATURE AT BOMBAY

M.S. Sanklecha and Riyaz I. Chagla, JJ.

COMMISSIONER OF CGST & CX, THANE

Versus

MAHINDRA & MAHINDRA LTD.

Central Excise Appeal No. 6 of 2018, decided on 19-9-2018

Appeal to High Court - Maintainability - Issue decided by Appellate

Tribunal on the basis of Revenue neutrality without going to contentions re-

garding valuation raised by Department - Appeal from order in respect of val-

uation and/or rate of duty issues passed in breach of natural justice would be

lie before Supreme Court - Jurisdiction of High Court in statutory Appeal de-

termined by terms of statute - Jurisdiction of High Court excluded in respect of

Tribunal’s orders relating to rates of duty and value of goods for purposes of

assessment, among other things - High Court cannot entertain appeal on the

ground of perceived hardship - Contention that undue hardship to general

body of litigants to move Supreme Court even when Tribunal’s orders were in

breach of natural justice and only remand to Tribunal for fresh consideration

was sought - Appeal not maintainable - Section 35G of Central Excise Act,

1944. - When there is any breach of natural justice is alleged, the Appellate Authority

would have to examine the underlying dispute and find out whether on facts any preju-

dice is caused to the party or is the remand going to be an empty formality in the facts of

this case. It is open to the Appellate Authority to decide the issue of valuation itself rather

than restore it before the Tribunal. Moreover, one cannot lose sight of the fact that Sec-

tion 35G of the Act under which the Appeal is filed, does not bestow jurisdiction on High

Court, to entertain an Appeal relating to rate of duty and/or valuation for the purposes of

assessment, in cases of grievance only of breach of natural justice. [paras 11, 12, 13, 14,

15]

Appeal dismissed

CASE CITED

Steel Authority of India v. Designated Authority — 2017 (349) E.L.T. 193 (S.C.)

— Referred ..................................................................................................................... [Paras 9, 10, 11, 13]

REPRESENTED BY : S/Shri Pradeep S. Jetly with Sham V. Walve, for the

Appellant.

S/Shri Prakash Shah with Ms. Divyesha Mathur and

Viraaj Bhate i/by PDS Legal, for the Respondent.

[Order]. - This Appeal under Section 35G of the Central Excise Act, 1944

(the Act) challenges the order dated 13th January 2017 passed by the Customs,

Excise and Service Tax Appellate Tribunal (for short “the Tribunal”).

2. The Appeal as filed by the Revenue urges the following three ques-

tions of law :

(a) Whether in the facts and circumstances of the case and in law was

the Tribunal right in deciding the issue merely on the ground of

revenue neutrality when in its earlier Order No. A/903-

EXCISE LAW TIMES 15th August 2020 174