Page 36 - GSTL_26th March 2020_Vol 34_Part 4

P. 36

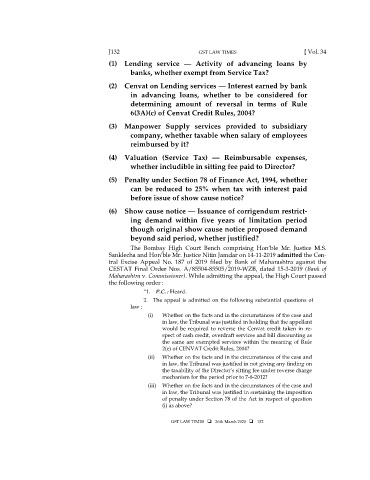

J132 GST LAW TIMES [ Vol. 34

(1) Lending service — Activity of advancing loans by

banks, whether exempt from Service Tax?

(2) Cenvat on Lending services — Interest earned by bank

in advancing loans, whether to be considered for

determining amount of reversal in terms of Rule

6(3A)(c) of Cenvat Credit Rules, 2004?

(3) Manpower Supply services provided to subsidiary

company, whether taxable when salary of employees

reimbursed by it?

(4) Valuation (Service Tax) — Reimbursable expenses,

whether includible in sitting fee paid to Director?

(5) Penalty under Section 78 of Finance Act, 1994, whether

can be reduced to 25% when tax with interest paid

before issue of show cause notice?

(6) Show cause notice — Issuance of corrigendum restrict-

ing demand within five years of limitation period

though original show cause notice proposed demand

beyond said period, whether justified?

The Bombay High Court Bench comprising Hon’ble Mr. Justice M.S.

Sanklecha and Hon’ble Mr. Justice Nitin Jamdar on 14-11-2019 admitted the Cen-

tral Excise Appeal No. 187 of 2019 filed by Bank of Maharashtra against the

CESTAT Final Order Nos. A/85504-85505/2019-WZB, dated 15-3-2019 (Bank of

Maharashtra v. Commissioner). While admitting the appeal, the High Court passed

the following order :

“1. P.C. : Heard.

2. The appeal is admitted on the following substantial questions of

law :

(i) Whether on the facts and in the circumstances of the case and

in law, the Tribunal was justified in holding that the appellant

would be required to reverse the Cenvat credit taken in re-

spect of cash credit, overdraft services and bill discounting as

the same are exempted services within the meaning of Rule

2(e) of CENVAT Credit Rules, 2004?

(ii) Whether on the facts and in the circumstances of the case and

in law, the Tribunal was justified in not giving any finding on

the taxability of the Director’s sitting fee under reverse charge

mechanism for the period prior to 7-8-2012?

(iii) Whether on the facts and in the circumstances of the case and

in law, the Tribunal was justified in sustaining the imposition

of penalty under Section 78 of the Act in respect of question

(i) as above?

GST LAW TIMES 26th March 2020 132

( A132 )