Page 38 - GSTL_26th March 2020_Vol 34_Part 4

P. 38

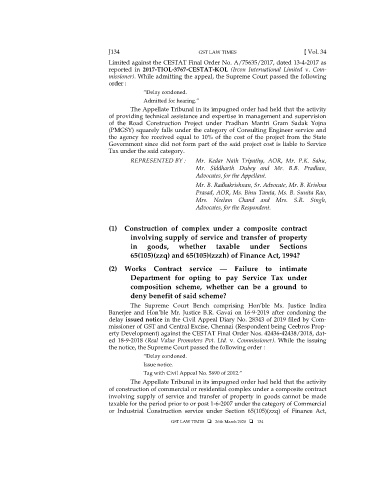

J134 GST LAW TIMES [ Vol. 34

Limited against the CESTAT Final Order No. A/75635/2017, dated 13-4-2017 as

reported in 2017-TIOL-3767-CESTAT-KOL (Ircon International Limited v. Com-

missioner). While admitting the appeal, the Supreme Court passed the following

order :

“Delay condoned.

Admitted for hearing.”

The Appellate Tribunal in its impugned order had held that the activity

of providing technical assistance and expertise in management and supervision

of the Road Construction Project under Pradhan Mantri Gram Sadak Yojna

(PMGSY) squarely falls under the category of Consulting Engineer service and

the agency fee received equal to 10% of the cost of the project from the State

Government since did not form part of the said project cost is liable to Service

Tax under the said category.

REPRESENTED BY : Mr. Kedar Nath Tripathy, AOR, Mr. P.K. Sahu,

Mr. Siddharth Dubey and Mr. B.B. Pradhan,

Advocates, for the Appellant.

Mr. B. Radhakrishnan, Sr. Advocate, Mr. B. Krishna

Prasad, AOR, Ms. Binu Tamta, Ms. B. Sunita Rao,

Mrs. Neelam Chand and Mrs. S.R. Singh,

Advocates, for the Respondent.

(1) Construction of complex under a composite contract

involving supply of service and transfer of property

in goods, whether taxable under Sections

65(105)(zzq) and 65(105)(zzzh) of Finance Act, 1994?

(2) Works Contract service — Failure to intimate

Department for opting to pay Service Tax under

composition scheme, whether can be a ground to

deny benefit of said scheme?

The Supreme Court Bench comprising Hon’ble Ms. Justice Indira

Banerjee and Hon’ble Mr. Justice B.R. Gavai on 16-9-2019 after condoning the

delay issued notice in the Civil Appeal Diary No. 28343 of 2019 filed by Com-

missioner of GST and Central Excise, Chennai (Respondent being Ceebros Prop-

erty Development) against the CESTAT Final Order Nos. 42436-42438/2018, dat-

ed 18-9-2018 (Real Value Promoters Pvt. Ltd. v. Commissioner). While the issuing

the notice, the Supreme Court passed the following order :

“Delay condoned.

Issue notice.

Tag with Civil Appeal No. 5690 of 2012.”

The Appellate Tribunal in its impugned order had held that the activity

of construction of commercial or residential complex under a composite contract

involving supply of service and transfer of property in goods cannot be made

taxable for the period prior to or post 1-6-2007 under the category of Commercial

or Industrial Construction service under Section 65(105)(zzq) of Finance Act,

GST LAW TIMES 26th March 2020 134

( A134 )