Page 103 - GSTL_16 April 2020_Vol 35_Part 3

P. 103

2020 ] IN RE : GITWAKO FARMS (INDIA) PRIVATE LIMITED 317

Additional submissions :

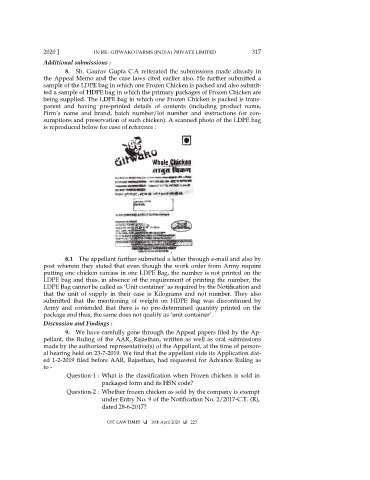

8. Sh. Gaurav Gupta C.A reiterated the submissions made already in

the Appeal Memo and the case laws cited earlier also. He further submitted a

sample of the LDPE bag in which one Frozen Chicken is packed and also submit-

ted a sample of HDPE bag in which the primary packages of Frozen Chicken are

being supplied. The LDPE bag in which one Frozen Chicken is packed is trans-

parent and having pre-printed details of contents (including product name,

Firm’s name and brand, batch number/lot number and instructions for con-

sumptions and preservation of such chicken). A scanned photo of the LDPE bag

is reproduced below for ease of reference :

8.1 The appellant further submitted a letter through e-mail and also by

post wherein they stated that even though the work order from Army require

putting one chicken carcass in one LDPE Bag, the number is not printed on the

LDPE bag and thus, in absence of the requirement of printing the number, the

LDPE Bag cannot be called as ‘Unit container’ as required by the Notification and

that the unit of supply in their case is Kilograms and not number. They also

submitted that the mentioning of weight on HDPE Bag was discontinued by

Army and contended that there is no pre-determined quantity printed on the

package and thus, the same does not qualify as ‘unit container’.

Discussion and Findings :

9. We have carefully gone through the Appeal papers filed by the Ap-

pellant, the Ruling of the AAR, Rajasthan, written as well as oral submissions

made by the authorized representative(s) of the Appellant, at the time of person-

al hearing held on 23-7-2019. We find that the appellant vide its Application dat-

ed 1-2-2019 filed before AAR, Rajasthan, had requested for Advance Ruling as

to -

Question-1 : What is the classification when Frozen chicken is sold in

packaged form and its HSN code?

Question-2 : Whether frozen chicken as sold by the company is exempt

under Entry No. 9 of the Notification No. 2/2017-C.T. (R),

dated 28-6-2017?

GST LAW TIMES 16th April 2020 223