Page 104 - GSTL_16 April 2020_Vol 35_Part 3

P. 104

318 GST LAW TIMES [ Vol. 35

10. In pursuance of the aforesaid Application dated 1-2-2019, the Au-

thority for Advance Ruling, Rajasthan (AAR, Rajasthan) in its Ruling No.

RAJ/AAR/2019-20/04, dated 22-4-2019 has pronounced its Ruling as under :

(a) The Branded Frozen Chicken supplied in a unit container is classifi-

able under HSN Code 0207 12 00.

(b) The Frozen Chicken supplied by the applicant is not exempted un-

der Entry No. 9 of the Notification No. 2/2017-C.T. (Rate), dated 28-

6-2017 (as amended from time to time).

11. The appellant is not satisfied with the above Ruling and has there-

fore filed the present appeal before this forum.

12. The appellant in the Appeal Memo has submitted that the Indian

Army awarded work order to them for supply of a specified amount of weight of

chicken dressed chilled/frozen over a specified period of time and also described

the process of manufacture, packing and supply of the same according to which

the bird is slaughtered and its carcass is processed, sealed and delivered in its

natural shape. During the process, each dressed chicken (broiler) carcass subse-

quent to chilling and before freezing is individually packed in a primary package

colourless LDPE bag and then it is put in a secondary package (HDPE Bag). The

appellant further submitted that various details/particulars viz. product name,

firm’s name and brand, net weight (if required), batch number/lot number and

instructions for consumptions and preservation are printed on such HDPE bags.

The package is specifically mentioned for Defence Personnel Only. Frozen chick-

en is then delivered in temperature controlled refrigerated vans with data logger

installed for continuous monitoring of frozen chicken. The appellant has con-

tended that each package in the present case may contain a different weight and

the quantity in these packages is not predetermined and also the predetermined

quantity (the quantity which is known prior to packaging) is not printed on the

packages and therefore, these packages would not qualify as ‘unit containers’.

13. From the process of manufacture, packing and supply, as described

by the appellant, we find that the appellant is, admittedly and undisputedly, en-

gaged in supply of Frozen Chicken in packaged form under its brand name of

‘Gitwako’ to the Indian Army and the Paramilitary forces against the tenders

issued by them.

14. The Authority for Advance Ruling, Rajasthan (AAR, Rajasthan) in

its Ruling No. RAJ/AAR/2019-20/04, dated 22-4-2019 has pronounced that Fro-

zen Chicken is classifiable under HSN Code 0207 12 00. The appellant has not

raised any objection in the instant appeal against the above ruling regarding clas-

sification of Frozen Chicken under HSN Code 0207 12 00.

15. The goods falling under Heading 0207 are leviable to GST in terms

of Notification No. 1/2017-C.T. (Rate), dated 28-6-2017 (as amended from time to

time). The relevant Entry of the Notification, prior to the amendment was as un-

der -

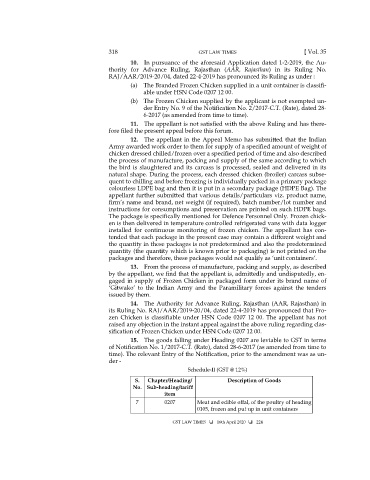

Schedule-II (GST @ 12%)

S. Chapter/Heading/ Description of Goods

No. Sub-heading/tariff

item

7 0207 Meat and edible offal, of the poultry of heading

0105, frozen and put up in unit containers

GST LAW TIMES 16th April 2020 224