Page 37 - GSTL_16 April 2020_Vol 35_Part 3

P. 37

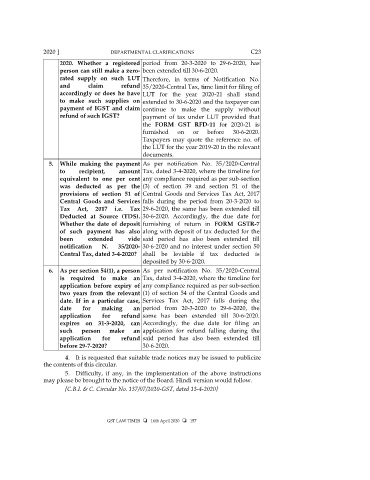

2020 ] DEPARTMENTAL CLARIFICATIONS C23

2020. Whether a registered period from 20-3-2020 to 29-6-2020, has

person can still make a zero- been extended till 30-6-2020.

rated supply on such LUT Therefore, in terms of Notification No.

and claim refund 35/2020-Central Tax, time limit for filing of

accordingly or does he have LUT for the year 2020-21 shall stand

to make such supplies on extended to 30-6-2020 and the taxpayer can

payment of IGST and claim continue to make the supply without

refund of such IGST? payment of tax under LUT provided that

the FORM GST RFD-11 for 2020-21 is

furnished on or before 30-6-2020.

Taxpayers may quote the reference no. of

the LUT for the year 2019-20 in the relevant

documents.

5. While making the payment As per notification No. 35/2020-Central

to recipient, amount Tax, dated 3-4-2020, where the timeline for

equivalent to one per cent any compliance required as per sub-section

was deducted as per the (3) of section 39 and section 51 of the

provisions of section 51 of Central Goods and Services Tax Act, 2017

Central Goods and Services falls during the period from 20-3-2020 to

Tax Act, 2017 i.e. Tax 29-6-2020, the same has been extended till

Deducted at Source (TDS). 30-6-2020. Accordingly, the due date for

Whether the date of deposit furnishing of return in FORM GSTR-7

of such payment has also along with deposit of tax deducted for the

been extended vide said period has also been extended till

notification N. 35/2020- 30-6-2020 and no interest under section 50

Central Tax, dated 3-4-2020? shall be leviable if tax deducted is

deposited by 30-6-2020.

6. As per section 54(1), a person As per notification No. 35/2020-Central

is required to make an Tax, dated 3-4-2020, where the timeline for

application before expiry of any compliance required as per sub-section

two years from the relevant (1) of section 54 of the Central Goods and

date. If in a particular case, Services Tax Act, 2017 falls during the

date for making an period from 20-3-2020 to 29-6-2020, the

application for refund same has been extended till 30-6-2020.

expires on 31-3-2020, can Accordingly, the due date for filing an

such person make an application for refund falling during the

application for refund said period has also been extended till

before 29-7-2020? 30-6-2020.

4. It is requested that suitable trade notices may be issued to publicize

the contents of this circular.

5. Difficulty, if any, in the implementation of the above instructions

may please be brought to the notice of the Board. Hindi version would follow.

[C.B.I. & C. Circular No. 137/07/2020-GST, dated 13-4-2020]

GST LAW TIMES 16th April 2020 157