Page 41 - GSTL_16 April 2020_Vol 35_Part 3

P. 41

2020 ] NOTIFICATIONS & RULES S35

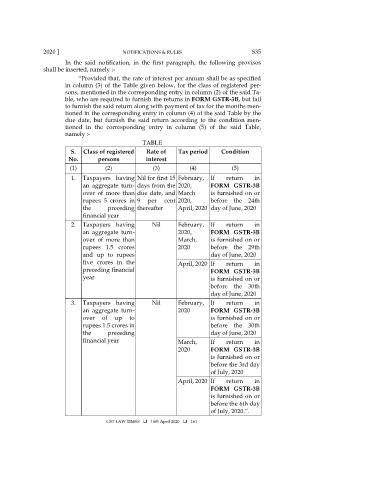

In the said notification, in the first paragraph, the following provisos

shall be inserted, namely :-

“Provided that, the rate of interest per annum shall be as specified

in column (3) of the Table given below, for the class of registered per-

sons, mentioned in the corresponding entry in column (2) of the said Ta-

ble, who are required to furnish the returns in FORM GSTR-3B, but fail

to furnish the said return along with payment of tax for the months men-

tioned in the corresponding entry in column (4) of the said Table by the

due date, but furnish the said return according to the condition men-

tioned in the corresponding entry in column (5) of the said Table,

namely :-

TABLE

S. Class of registered Rate of Tax period Condition

No. persons interest

(1) (2) (3) (4) (5)

1. Taxpayers having Nil for first 15 February, If return in

an aggregate turn- days from the 2020, FORM GSTR-3B

over of more than due date, and March is furnished on or

rupees 5 crores in 9 per cent 2020, before the 24th

the preceding thereafter April, 2020 day of June, 2020

financial year

2. Taxpayers having Nil February, If return in

an aggregate turn- 2020, FORM GSTR-3B

over of more than March, is furnished on or

rupees 1.5 crores 2020 before the 29th

and up to rupees day of June, 2020

five crores in the April, 2020 If return in

preceding financial FORM GSTR-3B

year is furnished on or

before the 30th

day of June, 2020

3. Taxpayers having Nil February, If return in

an aggregate turn- 2020 FORM GSTR-3B

over of up to is furnished on or

rupees 1.5 crores in before the 30th

the preceding day of June, 2020

financial year March, If return in

2020 FORM GSTR-3B

is furnished on or

before the 3rd day

of July, 2020

April, 2020 If return in

FORM GSTR-3B

is furnished on or

before the 6th day

of July, 2020.”.

GST LAW TIMES 16th April 2020 161