Page 76 - GSTL_16 April 2020_Vol 35_Part 3

P. 76

290 GST LAW TIMES [ Vol. 35

provided in taxable territory by one person to another shall be levied to tax, as

emphasized in Section 66B of Finance Act, 1994, introduced with Finance Act,

2012 - Hence, for post negative list era, services need not to be classified specif-

ically - Whenever service rendered and consideration in lieu thereof, in what-

ever form, received, same to be leviable to tax - Admittedly, assessee provided

space inside Club’s premises to book-makers, arranged for live telecast of

Matches conducted in other Race Clubs as also provided auditing facility and

catering services to book-makers - Also, assessee charged money from book-

makers on two counts; fixed amount for stall fee and profit based amount as

commission - Hence, both requirements of Section 66B ibid, stands fulfilled -

No infirmity in confirmation of demand for post negative period as well - Sec-

tion 66B of Finance Act, 1994. [para 23]

Appeals rejected

CASE CITED

Royal Western India Turf Club Ltd. v. Commissioner

— 2015 (38) S.T.R. 811 (Tribunal) — Distinguished ......................... [Paras 10, 11, 17, 18, 20, 21, 22]

DEPARTMENTAL CLARIFICATIONS CITED

C.B.E. & C. Circular No. 334/4/2006-TRU, dated 28-2-2006 ..................................................... [Paras 11, 21]

C.B.E. & C. Circular No. 109/3/2009-S.T., dated 23-2-2009 ............................................................. [Para 11]

REPRESENTED BY : Shri Y. Sreenivasa Reddy, Advocate, for the Appel-

lant.

Shri C. Mallikarjun Reddy, Authorised Representa-

tive, for the Respondent.

[Order per : Rachna Gupta, Member (J)]. - This order disposes of three

appeals together as the issue being common to all three of these appeals. Orders-

in-Original, as detailed below have been challenged in the impugned appeals

vide which the demands made against the appellant under the taxable service of

Business Support Service (BSS) and Renting of Immovable Property Service

(RIPS) has been confirmed along with interest and the penalty.

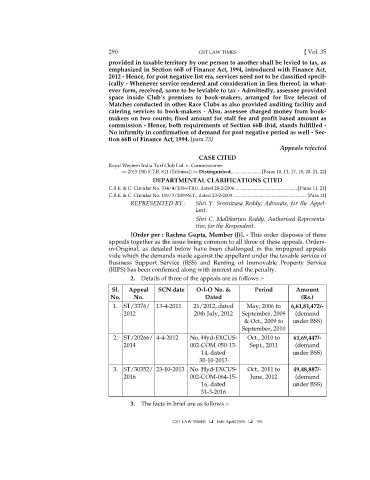

2. Details of three of the appeals are as follows :-

Sl. Appeal SCN date O-I-O No. & Period Amount

No. No. Dated (Rs.)

1. ST/3376/ 13-4-2011 21/2012, dated May, 2006 to 6,61,81,472/-

2012 20th July, 2012 September, 2009 (demand

& Oct., 2009 to under BSS)

September, 2010

2. ST/20266/ 4-4-2012 No. Hyd-EXCUS- Oct., 2010 to 61,69,447/-

2014 002-COM-050-13- Sept., 2011 (demand

14, dated under BSS)

30-10-2013

3. ST/30352/ 23-10-2013 No. Hyd-EXCUS- Oct., 2011 to 49,48,887/-

2016 002-COM-064-15- June, 2012 (demand

16, dated under BSS)

31-3-2016

3. The facts in brief are as follows :-

GST LAW TIMES 16th April 2020 196