Page 107 - GSTL_14th May 2020_Vol 36_Part 2

P. 107

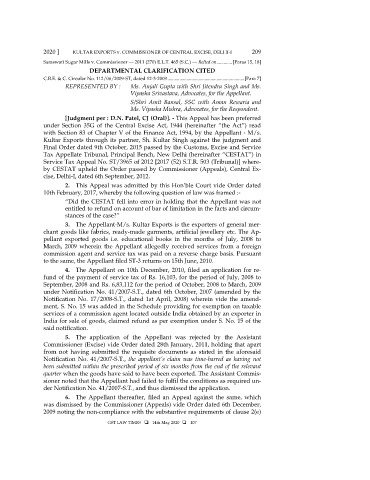

2020 ] KULTAR EXPORTS v. COMMISSIONER OF CENTRAL EXCISE, DELHI-I 209

Saraswati Sugar Mills v. Commissioner — 2011 (270) E.L.T. 465 (S.C.) — Relied on ............. [Paras 15, 18]

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Circular No. 112/06/2009-ST, dated 12-3-2009 ................................................................ [Para 7]

REPRESENTED BY : Ms. Anjali Gupta with Shri Jitendra Singh and Ms.

Vipasha Srivastava, Advocates, for the Appellant.

S/Shri Amit Bansal, SSC with Aman Rewaria and

Ms. Vipasha Mishra, Advocates, for the Respondent.

[Judgment per : D.N. Patel, CJ (Oral)]. - This Appeal has been preferred

under Section 35G of the Central Excise Act, 1944 (hereinafter “the Act”) read

with Section 83 of Chapter V of the Finance Act, 1994, by the Appellant - M/s.

Kultar Exports through its partner, Sh. Kultar Singh against the judgment and

Final Order dated 9th October, 2015 passed by the Customs, Excise and Service

Tax Appellate Tribunal, Principal Bench, New Delhi (hereinafter “CESTAT”) in

Service Tax Appeal No. ST/3965 of 2012 [2017 (52) S.T.R. 503 (Tribunal)] where-

by CESTAT upheld the Order passed by Commissioner (Appeals), Central Ex-

cise, Delhi-I, dated 6th September, 2012.

2. This Appeal was admitted by this Hon’ble Court vide Order dated

10th February, 2017, whereby the following question of law was framed :-

“Did the CESTAT fell into error in holding that the Appellant was not

entitled to refund on account of bar of limitation in the facts and circum-

stances of the case?”

3. The Appellant-M/s. Kultar Exports is the exporters of general mer-

chant goods like fabrics, ready-made garments, artificial jewellery etc. The Ap-

pellant exported goods i.e. educational books in the months of July, 2008 to

March, 2009 wherein the Appellant allegedly received services from a foreign

commission agent and service tax was paid on a reverse charge basis. Pursuant

to the same, the Appellant filed ST-3 returns on 15th June, 2010.

4. The Appellant on 10th December, 2010, filed an application for re-

fund of the payment of service tax of Rs. 16,103, for the period of July, 2008 to

September, 2008 and Rs. 6,83,112 for the period of October, 2008 to March, 2009

under Notification No. 41/2007-S.T., dated 6th October, 2007 (amended by the

Notification No. 17/2008-S.T., dated 1st April, 2008) wherein vide the amend-

ment, S. No. 15 was added in the Schedule providing for exemption on taxable

services of a commission agent located outside India obtained by an exporter in

India for sale of goods, claimed refund as per exemption under S. No. 15 of the

said notification.

5. The application of the Appellant was rejected by the Assistant

Commissioner (Excise) vide Order dated 28th January, 2011, holding that apart

from not having submitted the requisite documents as stated in the aforesaid

Notification No. 41/2007-S.T., the appellant’s claim was time-barred as having not

been submitted within the prescribed period of six months from the end of the relevant

quarter when the goods have said to have been exported. The Assistant Commis-

sioner noted that the Appellant had failed to fulfil the conditions as required un-

der Notification No. 41/2007-S.T., and thus dismissed the application.

6. The Appellant thereafter, filed an Appeal against the same, which

was dismissed by the Commissioner (Appeals) vide Order dated 6th December,

2009 noting the non-compliance with the substantive requirements of clause 2(e)

GST LAW TIMES 14th May 2020 107