Page 104 - GSTL_14th May 2020_Vol 36_Part 2

P. 104

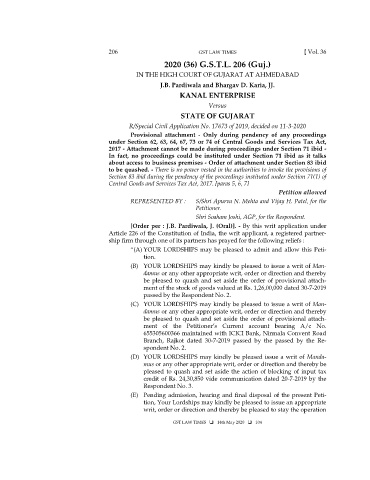

206 GST LAW TIMES [ Vol. 36

2020 (36) G.S.T.L. 206 (Guj.)

IN THE HIGH COURT OF GUJARAT AT AHMEDABAD

J.B. Pardiwala and Bhargav D. Karia, JJ.

KANAL ENTERPRISE

Versus

STATE OF GUJARAT

R/Special Civil Application No. 17673 of 2019, decided on 11-3-2020

Provisional attachment - Only during pendency of any proceedings

under Section 62, 63, 64, 67, 73 or 74 of Central Goods and Services Tax Act,

2017 - Attachment cannot be made during proceedings under Section 71 ibid -

In fact, no proceedings could be instituted under Section 71 ibid as it talks

about access to business premises - Order of attachment under Section 83 ibid

to be quashed. - There is no power vested in the authorities to invoke the provisions of

Section 83 ibid during the pendency of the proceedings instituted under Section 71(1) of

Central Goods and Services Tax Act, 2017. [paras 5, 6, 7]

Petition allowed

REPRESENTED BY : S/Shri Apurva N. Mehta and Vijay H. Patel, for the

Petitioner.

Shri Soaham Joshi, AGP, for the Respondent.

[Order per : J.B. Pardiwala, J. (Oral)]. - By this writ application under

Article 226 of the Constitution of India, the writ applicant, a registered partner-

ship firm through one of its partners has prayed for the following reliefs :

“(A) YOUR LORDSHIPS may be pleased to admit and allow this Peti-

tion.

(B) YOUR LORDSHIPS may kindly be pleased to issue a writ of Man-

damus or any other appropriate writ, order or direction and thereby

be pleased to quash and set aside the order of provisional attach-

ment of the stock of goods valued at Rs. 1,26,00,000 dated 30-7-2019

passed by the Respondent No. 2.

(C) YOUR LORDSHIPS may kindly be pleased to issue a writ of Man-

damus or any other appropriate writ, order or direction and thereby

be pleased to quash and set aside the order of provisional attach-

ment of the Petitioner’s Current account bearing A/c No.

655305600366 maintained with ICICI Bank, Nirmala Convent Road

Branch, Rajkot dated 30-7-2019 passed by the passed by the Re-

spondent No. 2.

(D) YOUR LORDSHIPS may kindly be pleased issue a writ of Manda-

mus or any other appropriate writ, order or direction and thereby be

pleased to quash and set aside the action of blocking of input tax

credit of Rs. 24,30,850 vide communication dated 20-7-2019 by the

Respondent No. 3.

(E) Pending admission, hearing and final disposal of the present Peti-

tion, Your Lordships may kindly be pleased to issue an appropriate

writ, order or direction and thereby be pleased to stay the operation

GST LAW TIMES 14th May 2020 104