Page 55 - GSTL_14th May 2020_Vol 36_Part 2

P. 55

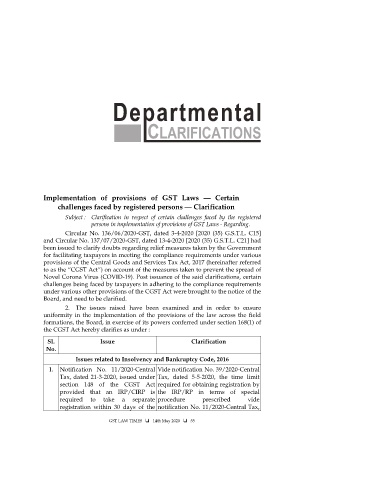

Implementation of provisions of GST Laws — Certain

challenges faced by registered persons — Clarification

Subject : Clarification in respect of certain challenges faced by the registered

persons in implementation of provisions of GST Laws - Regarding.

Circular No. 136/06/2020-GST, dated 3-4-2020 [2020 (35) G.S.T.L. C15]

and Circular No. 137/07/2020-GST, dated 13-4-2020 [2020 (35) G.S.T.L. C21] had

been issued to clarify doubts regarding relief measures taken by the Government

for facilitating taxpayers in meeting the compliance requirements under various

provisions of the Central Goods and Services Tax Act, 2017 (hereinafter referred

to as the “CGST Act”) on account of the measures taken to prevent the spread of

Novel Corona Virus (COVID-19). Post issuance of the said clarifications, certain

challenges being faced by taxpayers in adhering to the compliance requirements

under various other provisions of the CGST Act were brought to the notice of the

Board, and need to be clarified.

2. The issues raised have been examined and in order to ensure

uniformity in the implementation of the provisions of the law across the field

formations, the Board, in exercise of its powers conferred under section 168(1) of

the CGST Act hereby clarifies as under :

Sl. Issue Clarification

No.

Issues related to Insolvency and Bankruptcy Code, 2016

1. Notification No. 11/2020-Central Vide notification No. 39/2020-Central

Tax, dated 21-3-2020, issued under Tax, dated 5-5-2020, the time limit

section 148 of the CGST Act required for obtaining registration by

provided that an IRP/CIRP is the IRP/RP in terms of special

required to take a separate procedure prescribed vide

registration within 30 days of the notification No. 11/2020-Central Tax,

GST LAW TIMES 14th May 2020 55