Page 57 - GSTL_14th May 2020_Vol 36_Part 2

P. 57

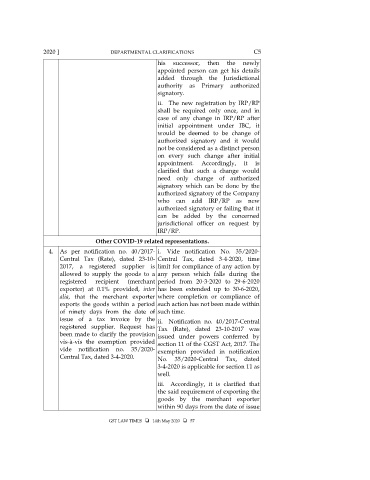

2020 ] DEPARTMENTAL CLARIFICATIONS C5

his successor, then the newly

appointed person can get his details

added through the Jurisdictional

authority as Primary authorized

signatory.

ii. The new registration by IRP/RP

shall be required only once, and in

case of any change in IRP/RP after

initial appointment under IBC, it

would be deemed to be change of

authorized signatory and it would

not be considered as a distinct person

on every such change after initial

appointment. Accordingly, it is

clarified that such a change would

need only change of authorized

signatory which can be done by the

authorized signatory of the Company

who can add IRP/RP as new

authorized signatory or failing that it

can be added by the concerned

jurisdictional officer on request by

IRP/RP.

Other COVID-19 related representations.

4. As per notification no. 40/2017- i. Vide notification No. 35/2020-

Central Tax (Rate), dated 23-10- Central Tax, dated 3-4-2020, time

2017, a registered supplier is limit for compliance of any action by

allowed to supply the goods to a any person which falls during the

registered recipient (merchant period from 20-3-2020 to 29-6-2020

exporter) at 0.1% provided, inter has been extended up to 30-6-2020,

alia, that the merchant exporter where completion or compliance of

exports the goods within a period such action has not been made within

of ninety days from the date of such time.

issue of a tax invoice by the ii. Notification no. 40/2017-Central

registered supplier. Request has Tax (Rate), dated 23-10-2017 was

been made to clarify the provision issued under powers conferred by

vis-à-vis the exemption provided section 11 of the CGST Act, 2017. The

vide notification no. 35/2020- exemption provided in notification

Central Tax, dated 3-4-2020. No. 35/2020-Central Tax, dated

3-4-2020 is applicable for section 11 as

well.

iii. Accordingly, it is clarified that

the said requirement of exporting the

goods by the merchant exporter

within 90 days from the date of issue

GST LAW TIMES 14th May 2020 57