Page 61 - GSTL_14th May 2020_Vol 36_Part 2

P. 61

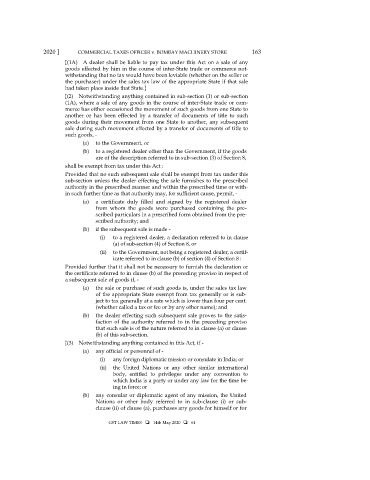

2020 ] COMMERCIAL TAXES OFFICER v. BOMBAY MACHINERY STORE 163

[(1A) A dealer shall be liable to pay tax under this Act on a sale of any

goods effected by him in the course of inter-State trade or commerce not-

withstanding that no tax would have been leviable (whether on the seller or

the purchaser) under the sales tax law of the appropriate State if that sale

had taken place inside that State.]

[(2) Notwithstanding anything contained in sub-section (1) or sub-section

(1A), where a sale of any goods in the course of inter-State trade or com-

merce has either occasioned the movement of such goods from one State to

another or has been effected by a transfer of documents of title to such

goods during their movement from one State to another, any subsequent

sale during such movement effected by a transfer of documents of title to

such goods, -

(a) to the Government, or

(b) to a registered dealer other than the Government, if the goods

are of the description referred to in sub-section (3) of Section 8,

shall be exempt from tax under this Act :

Provided that no such subsequent sale shall be exempt from tax under this

sub-section unless the dealer effecting the sale furnishes to the prescribed

authority in the prescribed manner and within the prescribed time or with-

in such further time as that authority may, for sufficient cause, permit, -

(a) a certificate duly filled and signed by the registered dealer

from whom the goods were purchased containing the pre-

scribed particulars in a prescribed form obtained from the pre-

scribed authority; and

(b) if the subsequent sale is made -

(i) to a registered dealer, a declaration referred to in clause

(a) of sub-section (4) of Section 8, or

(ii) to the Government, not being a registered dealer, a certif-

icate referred to in clause (b) of section (4) of Section 8 :

Provided further that it shall not be necessary to furnish the declaration or

the certificate referred to in clause (b) of the preceding proviso in respect of

a subsequent sale of goods if, -

(a) the sale or purchase of such goods is, under the sales tax law

of the appropriate State exempt from tax generally or is sub-

ject to tax generally at a rate which is lower than four per cent.

(whether called a tax or fee or by any other name); and

(b) the dealer effecting such subsequent sale proves to the satis-

faction of the authority referred to in the preceding proviso

that such sale is of the nature referred to in clause (a) or clause

(b) of this sub-section.

[(3) Notwithstanding anything contained in this Act, if -

(a) any official or personnel of -

(i) any foreign diplomatic mission or consulate in India; or

(ii) the United Nations or any other similar international

body, entitled to privileges under any convention to

which India is a party or under any law for the time be-

ing in force; or

(b) any consular or diplomatic agent of any mission, the United

Nations or other body referred to in sub-clause (i) or sub-

clause (ii) of clause (a), purchases any goods for himself or for

GST LAW TIMES 14th May 2020 61