Page 87 - GSTL_14th May 2020_Vol 36_Part 2

P. 87

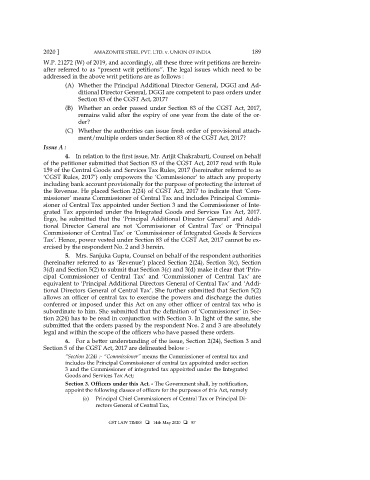

2020 ] AMAZONITE STEEL PVT. LTD. v. UNION OF INDIA 189

W.P. 21272 (W) of 2019, and accordingly, all these three writ petitions are herein-

after referred to as “present writ petitions”. The legal issues which need to be

addressed in the above writ petitions are as follows :

(A) Whether the Principal Additional Director General, DGGI and Ad-

ditional Director General, DGGI are competent to pass orders under

Section 83 of the CGST Act, 2017?

(B) Whether an order passed under Section 83 of the CGST Act, 2017,

remains valid after the expiry of one year from the date of the or-

der?

(C) Whether the authorities can issue fresh order of provisional attach-

ment/multiple orders under Section 83 of the CGST Act, 2017?

Issue A :

4. In relation to the first issue, Mr. Arijit Chakrabarti, Counsel on behalf

of the petitioner submitted that Section 83 of the CGST Act, 2017 read with Rule

159 of the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as

‘CGST Rules, 2017’) only empowers the ‘Commissioner’ to attach any property

including bank account provisionally for the purpose of protecting the interest of

the Revenue. He placed Section 2(24) of CGST Act, 2017 to indicate that ‘Com-

missioner’ means Commissioner of Central Tax and includes Principal Commis-

sioner of Central Tax appointed under Section 3 and the Commissioner of Inte-

grated Tax appointed under the Integrated Goods and Services Tax Act, 2017.

Ergo, he submitted that the ‘Principal Additional Director General’ and Addi-

tional Director General are not ‘Commissioner of Central Tax’ or ‘Principal

Commissioner of Central Tax’ or ‘Commissioner of Integrated Goods & Services

Tax’. Hence, power vested under Section 83 of the CGST Act, 2017 cannot be ex-

ercised by the respondent No. 2 and 3 herein.

5. Mrs. Sanjuka Gupta, Counsel on behalf of the respondent authorities

(hereinafter referred to as ‘Revenue’) placed Section 2(24), Section 3(c), Section

3(d) and Section 5(2) to submit that Section 3(c) and 3(d) make it clear that ‘Prin-

cipal Commissioner of Central Tax’ and ‘Commissioner of Central Tax’ are

equivalent to ‘Principal Additional Directors General of Central Tax’ and ‘Addi-

tional Directors General of Central Tax’. She further submitted that Section 5(2)

allows an officer of central tax to exercise the powers and discharge the duties

conferred or imposed under this Act on any other officer of central tax who is

subordinate to him. She submitted that the definition of ‘Commissioner’ in Sec-

tion 2(24) has to be read in conjunction with Section 3. In light of the same, she

submitted that the orders passed by the respondent Nos. 2 and 3 are absolutely

legal and within the scope of the officers who have passed these orders.

6. For a better understanding of the issue, Section 2(24), Section 3 and

Section 5 of the CGST Act, 2017 are delineated below :-

“Section 2(24) :- “Commissioner” means the Commissioner of central tax and

includes the Principal Commissioner of central tax appointed under section

3 and the Commissioner of integrated tax appointed under the Integrated

Goods and Services Tax Act;

Section 3. Officers under this Act. - The Government shall, by notification,

appoint the following classes of officers for the purposes of this Act, namely

(a) Principal Chief Commissioners of Central Tax or Principal Di-

rectors General of Central Tax,

GST LAW TIMES 14th May 2020 87