Page 119 - GSTL_21st May 2020_Vol 36_Part 3

P. 119

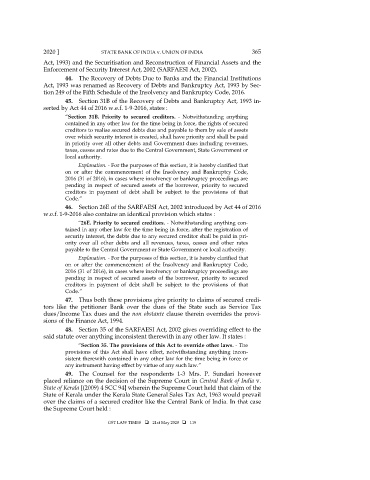

2020 ] STATE BANK OF INDIA v. UNION OF INDIA 365

Act, 1993) and the Securitisation and Reconstruction of Financial Assets and the

Enforcement of Security Interest Act, 2002 (SARFAESI Act, 2002).

44. The Recovery of Debts Due to Banks and the Financial Institutions

Act, 1993 was renamed as Recovery of Debts and Bankruptcy Act, 1993 by Sec-

tion 249 of the Fifth Schedule of the Insolvency and Bankruptcy Code, 2016.

45. Section 31B of the Recovery of Debts and Bankruptcy Act, 1993 in-

serted by Act 44 of 2016 w.e.f. 1-9-2016, states :

“Section 31B. Priority to secured creditors. - Notwithstanding anything

contained in any other law for the time being in force, the rights of secured

creditors to realise secured debts due and payable to them by sale of assets

over which security interest is created, shall have priority and shall be paid

in priority over all other debts and Government dues including revenues,

taxes, cesses and rates due to the Central Government, State Government or

local authority.

Explanation. - For the purposes of this section, it is hereby clarified that

on or after the commencement of the Insolvency and Bankruptcy Code,

2016 (31 of 2016), in cases where insolvency or bankruptcy proceedings are

pending in respect of secured assets of the borrower, priority to secured

creditors in payment of debt shall be subject to the provisions of that

Code.”

46. Section 26E of the SARFAESI Act, 2002 introduced by Act 44 of 2016

w.e.f. 1-9-2016 also contains an identical provision which states :

“26E. Priority to secured creditors. - Notwithstanding anything con-

tained in any other law for the time being in force, after the registration of

security interest, the debts due to any secured creditor shall be paid in pri-

ority over all other debts and all revenues, taxes, cesses and other rates

payable to the Central Government or State Government or local authority.

Explanation. - For the purposes of this section, it is hereby clarified that

on or after the commencement of the Insolvency and Bankruptcy Code,

2016 (31 of 2016), in cases where insolvency or bankruptcy proceedings are

pending in respect of secured assets of the borrower, priority to secured

creditors in payment of debt shall be subject to the provisions of that

Code.”

47. Thus both these provisions give priority to claims of secured credi-

tors like the petitioner Bank over the dues of the State such as Service Tax

dues/Income Tax dues and the non obstante clause therein overrides the provi-

sions of the Finance Act, 1994.

48. Section 35 of the SARFAESI Act, 2002 gives overriding effect to the

said statute over anything inconsistent therewith in any other law. It states :

“Section 35. The provisions of this Act to override other laws. - The

provisions of this Act shall have effect, notwithstanding anything incon-

sistent therewith contained in any other law for the time being in force or

any instrument having effect by virtue of any such law.”

49. The Counsel for the respondents 1-3 Mrs. P. Sundari however

placed reliance on the decision of the Supreme Court in Central Bank of India v.

State of Kerala [(2009) 4 SCC 94] wherein the Supreme Court held that claim of the

State of Kerala under the Kerala State General Sales Tax Act, 1963 would prevail

over the claims of a secured creditor like the Central Bank of India. In that case

the Supreme Court held :

GST LAW TIMES 21st May 2020 119