Page 123 - GSTL_21st May 2020_Vol 36_Part 3

P. 123

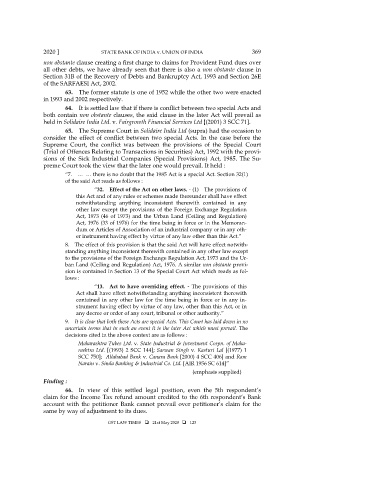

2020 ] STATE BANK OF INDIA v. UNION OF INDIA 369

non obstante clause creating a first charge to claims for Provident Fund dues over

all other debts, we have already seen that there is also a non obstante clause in

Section 31B of the Recovery of Debts and Bankruptcy Act, 1993 and Section 26E

of the SARFAESI Act, 2002.

63. The former statute is one of 1952 while the other two were enacted

in 1993 and 2002 respectively.

64. It is settled law that if there is conflict between two special Acts and

both contain non obstante clauses, the said clause in the later Act will prevail as

held in Solidaire India Ltd. v. Fairgrowth Financial Services Ltd [(2001) 3 SCC 71].

65. The Supreme Court in Solidaire India Ltd (supra) had the occasion to

consider the effect of conflict between two special Acts. In the case before the

Supreme Court, the conflict was between the provisions of the Special Court

(Trial of Offences Relating to Transactions in Securities) Act, 1992 with the provi-

sions of the Sick Industrial Companies (Special Provisions) Act, 1985. The Su-

preme Court took the view that the later one would prevail. It held :

“7. … … there is no doubt that the 1985 Act is a special Act. Section 32(1)

of the said Act reads as follows :

“32. Effect of the Act on other laws. - (1) The provisions of

this Act and of any rules or schemes made thereunder shall have effect

notwithstanding anything inconsistent therewith contained in any

other law except the provisions of the Foreign Exchange Regulation

Act, 1973 (46 of 1973) and the Urban Land (Ceiling and Regulation)

Act, 1976 (33 of 1976) for the time being in force or in the Memoran-

dum or Articles of Association of an industrial company or in any oth-

er instrument having effect by virtue of any law other than this Act.”

8. The effect of this provision is that the said Act will have effect notwith-

standing anything inconsistent therewith contained in any other law except

to the provisions of the Foreign Exchange Regulation Act, 1973 and the Ur-

ban Land (Ceiling and Regulation) Act, 1976. A similar non obstante provi-

sion is contained in Section 13 of the Special Court Act which reads as fol-

lows :

“13. Act to have overriding effect. - The provisions of this

Act shall have effect notwithstanding anything inconsistent therewith

contained in any other law for the time being in force or in any in-

strument having effect by virtue of any law, other than this Act, or in

any decree or order of any court, tribunal or other authority.”

9. It is clear that both these Acts are special Acts. This Court has laid down in no

uncertain terms that in such an event it is the later Act which must prevail. The

decisions cited in the above context are as follows :

Maharashtra Tubes Ltd. v. State Industrial & Investment Corpn. of Maha-

rashtra Ltd. [(1993) 2 SCC 144]; Sarwan Singh v. Kasturi Lal [(1977) 1

SCC 750]; Allahabad Bank v. Canara Bank [2000) 4 SCC 406] and Ram

Narain v. Simla Banking & Industrial Co. Ltd. [AIR 1956 SC 614]”

(emphasis supplied)

Finding :

66. In view of this settled legal position, even the 5th respondent’s

claim for the Income Tax refund amount credited to the 6th respondent’s Bank

account with the petitioner Bank cannot prevail over petitioner’s claim for the

same by way of adjustment to its dues.

GST LAW TIMES 21st May 2020 123