Page 125 - GSTL_21st May 2020_Vol 36_Part 3

P. 125

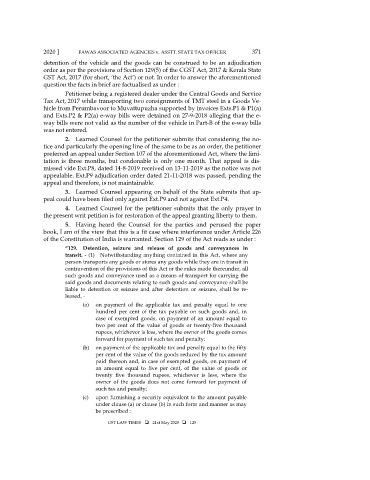

2020 ] FAWAS ASSOCIATED AGENCIES v. ASSTT. STATE TAX OFFICER 371

detention of the vehicle and the goods can be construed to be an adjudication

order as per the provisions of Section 129(5) of the CGST Act, 2017 & Kerala State

GST Act, 2017 (for short, ‘the Act’) or not. In order to answer the aforementioned

question the facts in brief are factualised as under :

Petitioner being a registered dealer under the Central Goods and Service

Tax Act, 2017 while transporting two consignments of TMT steel in a Goods Ve-

hicle from Perumbavoor to Muvattupuzha supported by invoices Exts.P1 & P1(a)

and Exts.P2 & P2(a) e-way bills were detained on 27-9-2018 alleging that the e-

way bills were not valid as the number of the vehicle in Part-B of the e-way bills

was not entered.

2. Learned Counsel for the petitioner submits that considering the no-

tice and particularly the opening line of the same to be as an order, the petitioner

preferred an appeal under Section 107 of the aforementioned Act, where the limi-

tation is three months, but condonable is only one month. That appeal is dis-

missed vide Ext.P8, dated 14-8-2019 received on 13-11-2019 as the notice was not

appealable. Ext.P9 adjudication order dated 21-11-2018 was passed, pending the

appeal and therefore, is not maintainable.

3. Learned Counsel appearing on behalf of the State submits that ap-

peal could have been filed only against Ext.P9 and not against Ext.P4.

4. Learned Counsel for the petitioner submits that the only prayer in

the present writ petition is for restoration of the appeal granting liberty to them.

5. Having heard the Counsel for the parties and perused the paper

book, I am of the view that this is a fit case where interference under Article 226

of the Constitution of India is warranted. Section 129 of the Act reads as under :

“129. Detention, seizure and release of goods and conveyances in

transit. - (1) Notwithstanding anything contained in this Act, where any

person transports any goods or stores any goods while they are in transit in

contravention of the provisions of this Act or the rules made thereunder, all

such goods and conveyance used as a means of transport for carrying the

said goods and documents relating to such goods and conveyance shall be

liable to detention or seizure and after detention or seizure, shall be re-

leased, -

(a) on payment of the applicable tax and penalty equal to one

hundred per cent of the tax payable on such goods and, in

case of exempted goods, on payment of an amount equal to

two per cent of the value of goods or twenty-five thousand

rupees, whichever is less, where the owner of the goods comes

forward for payment of such tax and penalty;

(b) on payment of the applicable tax and penalty equal to the fifty

per cent of the value of the goods reduced by the tax amount

paid thereon and, in case of exempted goods, on payment of

an amount equal to five per cent, of the value of goods or

twenty five thousand rupees, whichever is less, where the

owner of the goods does not come forward for payment of

such tax and penalty;

(c) upon furnishing a security equivalent to the amount payable

under clause (a) or clause (b) in such form and manner as may

be prescribed :

GST LAW TIMES 21st May 2020 125