Page 127 - GSTL_21st May 2020_Vol 36_Part 3

P. 127

2020 ] IN RE : SHRI BALAJI INDUSTRIES PRODUCTS LTD. 373

2020 (36) G.S.T.L. 373 (Commr. Appl. - GST - Raj.)

BEFORE THE COMMISSIONER OF GST (APPEALS), JAIPUR

Shri J.P. Meena, Additional Commissioner (Appeals)

IN RE : SHRI BALAJI INDUSTRIES PRODUCTS LTD.

Order-in-Appeal Nos. 05-09 (JPM) CGST/JPR/2019, dated 24-12-2019

in Application C. Nos. APPL/JPR/CGST/JP/25, 24, 23, 22 & 26/IX/18

Refund on returned goods - Duty paid goods rejected and returned -

Central Excise duty paid on goods cleared before appointed day but goods re-

turned by the receiver after appointed day - Appellant failed to establish iden-

tity of goods to the satisfaction of the proper officer, rejected goods being men-

tioned in weight as the unit in the copy of Stock/RG-1 register, while in all the

documents, i.e., invoices, transport note, out gate pass, quantity of rejected

goods mentioned in Number - Further receiver of goods being registered with

GSTN, goods returned to be treated as ‘Deemed Supply’ in their hands in

terms of proviso to Section 142(1) of Central Goods and Services Tax Act, 2017

and receiver of goods required to charge GST on the Deemed Supply - Refund

not admissible. [paras 5, 6, 7]

Appeals rejected

[Order]. - The above Five (5) appeals have been filed before the appellate

authority under Section 107 of the Central Goods and Services Tax Act, 2017 by

M/s. Shri Balaji Industries Products Limited, 48, Industrial Area, Jhotwara, Jai-

pur (Hereinafter also referred to as “the appellant”) against the Orders-in-

Original (Hereinafter called as the “impugned orders”) passed by the Deputy

Commissioner, Central Goods & Services Tax Division-A, Jaipur (Hereinafter

called as the “adjudication authority”) as mentioned below :-

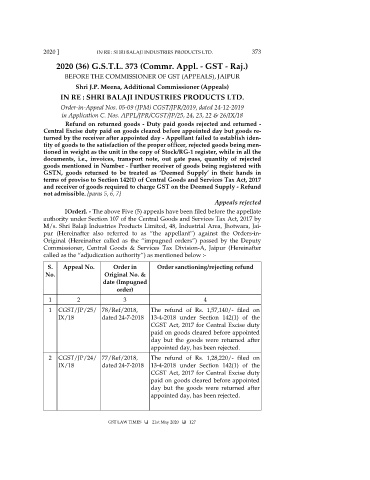

S. Appeal No. Order in Order sanctioning/rejecting refund

No. Original No. &

date (Impugned

order)

1 2 3 4

1 CGST/JP/25/ 78/Ref/2018, The refund of Rs. 1,57,140/- filed on

IX/18 dated 24-7-2018 13-4-2018 under Section 142(1) of the

CGST Act, 2017 for Central Excise duty

paid on goods cleared before appointed

day but the goods were returned after

appointed day, has been rejected.

2 CGST/JP/24/ 77/Ref/2018, The refund of Rs. 1,28,220/- filed on

IX/18 dated 24-7-2018 13-4-2018 under Section 142(1) of the

CGST Act, 2017 for Central Excise duty

paid on goods cleared before appointed

day but the goods were returned after

appointed day, has been rejected.

GST LAW TIMES 21st May 2020 127