Page 128 - GSTL_21st May 2020_Vol 36_Part 3

P. 128

374 GST LAW TIMES [ Vol. 36

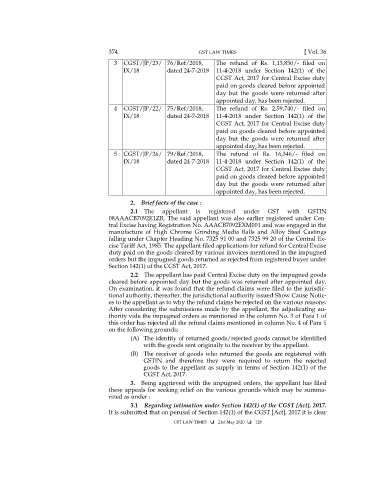

3 CGST/JP/23/ 76/Ref/2018, The refund of Rs. 1,13,850/- filed on

IX/18 dated 24-7-2018 11-4-2018 under Section 142(1) of the

CGST Act, 2017 for Central Excise duty

paid on goods cleared before appointed

day but the goods were returned after

appointed day, has been rejected.

4 CGST/JP/22/ 75/Ref/2018, The refund of Rs. 2,59,740/- filed on

IX/18 dated 24-7-2018 11-4-2018 under Section 142(1) of the

CGST Act, 2017 for Central Excise duty

paid on goods cleared before appointed

day but the goods were returned after

appointed day, has been rejected.

5 CGST/JP/26/ 79/Ref/2018, The refund of Rs. 16,346/- filed on

IX/18 dated 24-7-2018 11-4-2018 under Section 142(1) of the

CGST Act, 2017 for Central Excise duty

paid on goods cleared before appointed

day but the goods were returned after

appointed day, has been rejected.

2. Brief facts of the case :

2.1 The appellant is registered under GST with GSTIN

08AAACB7092E1ZR. The said appellant was also earlier registered under Cen-

tral Excise having Registration No. AAACB7092EXM001 and was engaged in the

manufacture of High Chrome Grinding Media Balls and Alloy Steel Castings

falling under Chapter Heading No. 7325 91 00 and 7325 99 20 of the Central Ex-

cise Tariff Act, 1985. The appellant filed applications for refund for Central Excise

duty paid on the goods cleared by various invoices mentioned in the impugned

orders but the impugned goods returned as rejected from registered buyer under

Section 142(1) of the CGST Act, 2017.

2.2 The appellant has paid Central Excise duty on the impugned goods

cleared before appointed day but the goods was returned after appointed day.

On examination, it was found that the refund claims were filed to the jurisdic-

tional authority, thereafter, the jurisdictional authority issued Show Cause Notic-

es to the appellant as to why the refund claims be rejected on the various reasons.

After considering the submissions made by the appellant, the adjudicating au-

thority vide the impugned orders as mentioned in the column No. 3 of Para 1 of

this order has rejected all the refund claims mentioned in column No. 4 of Para 1

on the following grounds;

(A) The identity of returned goods/rejected goods cannot be identified

with the goods sent originally to the receiver by the appellant.

(B) The receiver of goods who returned the goods are registered with

GSTIN and therefore they were required to return the rejected

goods to the appellant as supply in terms of Section 142(1) of the

CGST Act, 2017.

3. Being aggrieved with the impugned orders, the appellant has filed

these appeals for seeking relief on the various grounds which may be summa-

rized as under :

3.1 Regarding intimation under Section 142(1) of the CGST [Act], 2017.

It is submitted that on perusal of Section 142(1) of the CGST [Act], 2017 it is clear

GST LAW TIMES 21st May 2020 128