Page 135 - GSTL_21st May 2020_Vol 36_Part 3

P. 135

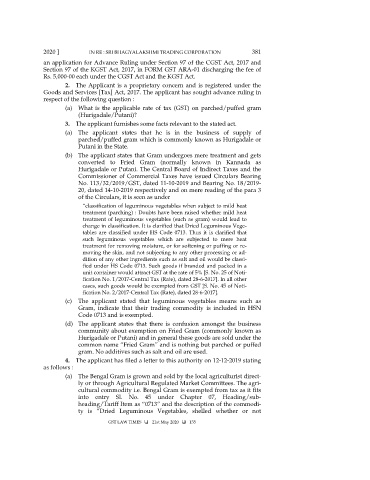

2020 ] IN RE : SRI BHAGYALAKSHMI TRADING CORPORATION 381

an application for Advance Ruling under Section 97 of the CGST Act, 2017 and

Section 97 of the KGST Act, 2017, in FORM GST ARA-01 discharging the fee of

Rs. 5,000-00 each under the CGST Act and the KGST Act.

2. The Applicant is a proprietary concern and is registered under the

Goods and Services [Tax] Act, 2017. The applicant has sought advance ruling in

respect of the following question :

(a) What is the applicable rate of tax (GST) on parched/puffed gram

(Hurigadale/Putani)?

3. The applicant furnishes some facts relevant to the stated act.

(a) The applicant states that he is in the business of supply of

parched/puffed gram which is commonly known as Hurigadale or

Putani in the State.

(b) The applicant states that Gram undergoes mere treatment and gets

converted to Fried Gram (normally known in Kannada as

Hurigadale or Putani. The Central Board of Indirect Taxes and the

Commissioner of Commercial Taxes have issued Circulars Bearing

No. 113/32/2019/GST, dated 11-10-2019 and Bearing No. 18/2019-

20, dated 14-10-2019 respectively and on mere reading of the para 3

of the Circulars, it is seen as under

“classification of leguminous vegetables when subject to mild heat

treatment (parching) : Doubts have been raised whether mild heat

treatment of leguminous vegetables (such as gram) would lead to

change in classification. It is clarified that Dried Leguminous Vege-

tables are classified under HS Code 0713. Thus it is clarified that

such leguminous vegetables which are subjected to mere heat

treatment for removing moisture, or for softening or puffing or re-

moving the skin, and not subjecting to any other processing or ad-

dition of any other ingredients such as salt and oil would be classi-

fied under HS Code 0713. Such goods if branded and packed in a

unit container would attract GST at the rate of 5% [S. No. 25 of Noti-

fication No. 1/2017-Central Tax (Rate), dated 28-6-2017]. In all other

cases, such goods would be exempted from GST [S. No. 45 of Noti-

fication No. 2/2017-Central Tax (Rate), dated 28-6-2017].

(c) The applicant stated that leguminous vegetables means such as

Gram, indicate that their trading commodity is included in HSN

Code 0713 and is exempted.

(d) The applicant states that there is confusion amongst the business

community about exemption on Fried Gram (commonly known as

Hurigadale or Putani) and in general these goods are sold under the

common name “Fried Gram” and is nothing but parched or puffed

gram. No additives such as salt and oil are used.

4. The applicant has filed a letter to this authority on 12-12-2019 stating

as follows :

(a) The Bengal Gram is grown and sold by the local agriculturist direct-

ly or through Agricultural Regulated Market Committees. The agri-

cultural commodity i.e. Bengal Gram is exempted from tax as it fits

into entry Sl. No. 45 under Chapter 07, Heading/sub-

heading/Tariff Item as “0713” and the description of the commodi-

ty is “Dried Leguminous Vegetables, shelled whether or not

GST LAW TIMES 21st May 2020 135