Page 140 - GSTL_21st May 2020_Vol 36_Part 3

P. 140

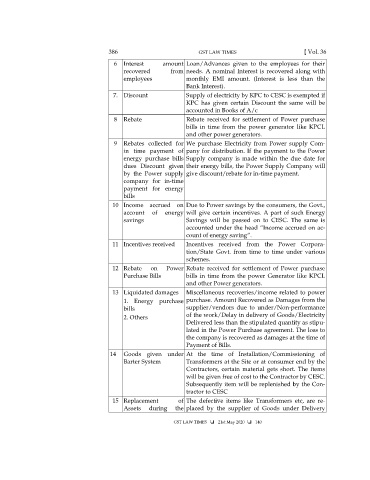

386 GST LAW TIMES [ Vol. 36

6 Interest amount Loan/Advances given to the employees for their

recovered from needs. A nominal Interest is recovered along with

employees monthly EMI amount. (Interest is less than the

Bank Interest).

7. Discount Supply of electricity by KPC to CESC is exempted if

KPC has given certain Discount the same will be

accounted in Books of A/c

8 Rebate Rebate received for settlement of Power purchase

bills in time from the power generator like KPCL

and other power generators.

9 Rebates collected for We purchase Electricity from Power supply Com-

in time payment of pany for distribution. If the payment to the Power

energy purchase bills Supply company is made within the due date for

dues Discount given their energy bills, the Power Supply Company will

by the Power supply give discount/rebate for in-time payment.

company for in-time

payment for energy

bills

10 Income accrued on Due to Power savings by the consumers, the Govt.,

account of energy will give certain incentives. A part of such Energy

savings Savings will be passed on to CESC. The same is

accounted under the head “Income accrued on ac-

count of energy saving”.

11 Incentives received Incentives received from the Power Corpora-

tion/State Govt. from time to time under various

schemes.

12 Rebate on Power Rebate received for settlement of Power purchase

Purchase Bills bills in time from the power Generator like KPCL

and other Power generators.

13 Liquidated damages Miscellaneous recoveries/income related to power

1. Energy purchase purchase. Amount Recovered as Damages from the

bills supplier/vendors due to under/Non-performance

2. Others of the work/Delay in delivery of Goods/Electricity

Delivered less than the stipulated quantity as stipu-

lated in the Power Purchase agreement. The loss to

the company is recovered as damages at the time of

Payment of Bills.

14 Goods given under At the time of Installation/Commissioning of

Barter System Transformers at the Site or at consumer end by the

Contractors, certain material gets short. The items

will be given free of cost to the Contractor by CESC.

Subsequently item will be replenished by the Con-

tractor to CESC

15 Replacement of The defective items like Transformers etc, are re-

Assets during the placed by the supplier of Goods under Delivery

GST LAW TIMES 21st May 2020 140