Page 142 - GSTL_21st May 2020_Vol 36_Part 3

P. 142

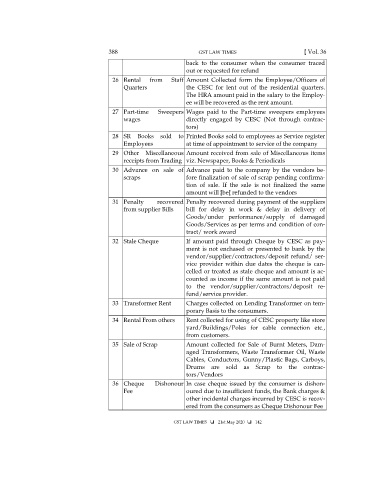

388 GST LAW TIMES [ Vol. 36

back to the consumer when the consumer traced

out or requested for refund

26 Rental from Staff Amount Collected form the Employee/Officers of

Quarters the CESC for lent out of the residential quarters.

The HRA amount paid in the salary to the Employ-

ee will be recovered as the rent amount.

27 Part-time Sweepers Wages paid to the Part-time sweepers employees

wages directly engaged by CESC (Not through contrac-

tors)

28 SR Books sold to Printed Books sold to employees as Service register

Employees at time of appointment to service of the company

29 Other Miscellaneous Amount received from sale of Miscellaneous items

receipts from Trading viz. Newspaper, Books & Periodicals

30 Advance on sale of Advance paid to the company by the vendors be-

scraps fore finalization of sale of scrap pending confirma-

tion of sale. If the sale is not finalized the same

amount will [be] refunded to the vendors

31 Penalty recovered Penalty recovered during payment of the suppliers

from supplier Bills bill for delay in work & delay in delivery of

Goods/under performance/supply of damaged

Goods/Services as per terms and condition of con-

tract/ work award

32 Stale Cheque If amount paid through Cheque by CESC as pay-

ment is not enchased or presented to bank by the

vendor/supplier/contractors/deposit refund/ ser-

vice provider within due dates the cheque is can-

celled or treated as stale cheque and amount is ac-

counted as income if the same amount is not paid

to the vendor/supplier/contractors/deposit re-

fund/service provider.

33 Transformer Rent Charges collected on Lending Transformer on tem-

porary Basis to the consumers.

34 Rental From others Rent collected for using of CESC property like store

yard/Buildings/Poles for cable connection etc.,

from customers.

35 Sale of Scrap Amount collected for Sale of Burnt Meters, Dam-

aged Transformers, Waste Transformer Oil, Waste

Cables, Conductors, Gunny/Plastic Bags, Carboys,

Drums are sold as Scrap to the contrac-

tors/Vendors

36 Cheque Dishonour In case cheque issued by the consumer is dishon-

Fee oured due to insufficient funds, the Bank charges &

other incidental charges incurred by CESC is recov-

ered from the consumers as Cheque Dishonour Fee

GST LAW TIMES 21st May 2020 142