Page 145 - GSTL_21st May 2020_Vol 36_Part 3

P. 145

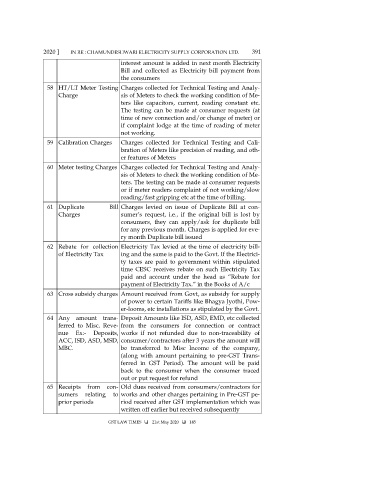

2020 ] IN RE : CHAMUNDESHWARI ELECTRICITY SUPPLY CORPORATION LTD. 391

interest amount is added in next month Electricity

Bill and collected as Electricity bill payment from

the consumers

58 HT/LT Meter Testing Charges collected for Technical Testing and Analy-

Charge sis of Meters to check the working condition of Me-

ters like capacitors, current, reading constant etc.

The testing can be made at consumer requests (at

time of new connection and/or change of meter) or

if complaint lodge at the time of reading of meter

not working.

59 Calibration Charges Charges collected for Technical Testing and Cali-

bration of Meters like precision of reading, and oth-

er features of Meters

60 Meter testing Charges Charges collected for Technical Testing and Analy-

sis of Meters to check the working condition of Me-

ters. The testing can be made at consumer requests

or if meter readers complaint of not working/slow

reading/fast gripping etc at the time of billing.

61 Duplicate Bill Charges levied on issue of Duplicate Bill at con-

Charges sumer’s request, i.e., if the original bill is lost by

consumers, they can apply/ask for duplicate bill

for any previous month. Charges is applied for eve-

ry month Duplicate bill issued

62 Rebate for collection Electricity Tax levied at the time of electricity bill-

of Electricity Tax ing and the same is paid to the Govt. If the Electrici-

ty taxes are paid to government within stipulated

time CESC receives rebate on such Electricity Tax

paid and account under the head as “Rebate for

payment of Electricity Tax.” in the Books of A/c

63 Cross subsidy charges Amount received from Govt, as subsidy for supply

of power to certain Tariffs like Bhagya Jyothi, Pow-

er-looms, etc installations as stipulated by the Govt.

64 Any amount trans- Deposit Amounts like ISD, ASD, EMD, etc collected

ferred to Misc. Reve- from the consumers for connection or contract

nue Ex:- Deposits, works if not refunded due to non-traceability of

ACC, ISD, ASD, MSD, consumer/contractors after 3 years the amount will

MBC. be transferred to Misc Income of the company,

(along with amount pertaining to pre-GST Trans-

ferred in GST Period). The amount will be paid

back to the consumer when the consumer traced

out or put request for refund

65 Receipts from con- Old dues received from consumers/contractors for

sumers relating to works and other charges pertaining in Pre-GST pe-

prior periods riod received after GST implementation which was

written off earlier but received subsequently

GST LAW TIMES 21st May 2020 145