Page 148 - GSTL_21st May 2020_Vol 36_Part 3

P. 148

394 GST LAW TIMES [ Vol. 36

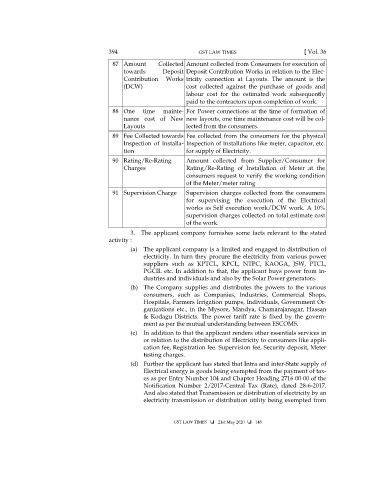

87 Amount Collected Amount collected from Consumers for execution of

towards Deposit Deposit Contribution Works in relation to the Elec-

Contribution Works tricity connection at Layouts. The amount is the

(DCW) cost collected against the purchase of goods and

labour cost for the estimated work subsequently

paid to the contractors upon completion of work.

88 One time mainte- For Power connections at the time of formation of

nance cost of New new layouts, one time maintenance cost will be col-

Layouts lected from the consumers.

89 Fee Collected towards Fee collected from the consumers for the physical

Inspection of Installa- Inspection of Installations like meter, capacitor, etc.

tion for supply of Electricity.

90 Rating/Re-Rating Amount collected from Supplier/Consumer for

Charges Rating/Re-Rating of Installation of Meter at the

consumers request to verify the working condition

of the Meter/meter rating

91 Supervision Charge Supervision charges collected from the consumers

for supervising the execution of the Electrical

works as Self execution work/DCW work. A 10%

supervision charges collected on total estimate cost

of the work.

3. The applicant company furnishes some facts relevant to the stated

activity :

(a) The applicant company is a limited and engaged in distribution of

electricity. In turn they procure the electricity from various power

suppliers such as KPTCL, KPCL, NTPC, KAOGA, JSW, PTCL,

PGCIL etc. In addition to that, the applicant buys power from in-

dustries and individuals and also by the Solar Power generators.

(b) The Company supplies and distributes the powers to the various

consumers, such as Companies, Industries, Commercial Shops,

Hospitals, Farmers Irrigation pumps, Individuals, Government Or-

ganizations etc., in the Mysore, Mandya, Chamarajanagar, Hassan

& Kodagu Districts. The power tariff rate is fixed by the govern-

ment as per the mutual understanding between ESCOMS.

(c) In addition to that the applicant renders other essentials services in

or relation to the distribution of Electricity to consumers like appli-

cation fee, Registration fee. Supervision fee, Security deposit, Meter

testing charges.

(d) Further the applicant has stated that Intra and inter-State supply of

Electrical energy is goods being exempted from the payment of tax-

es as per Entry Number 104 and Chapter Heading 2716 00 00 of the

Notification Number 2/2017-Central Tax (Rate), dated 28-6-2017.

And also stated that Transmission or distribution of electricity by an

electricity transmission or distribution utility being exempted from

GST LAW TIMES 21st May 2020 148