Page 141 - GSTL_21st May 2020_Vol 36_Part 3

P. 141

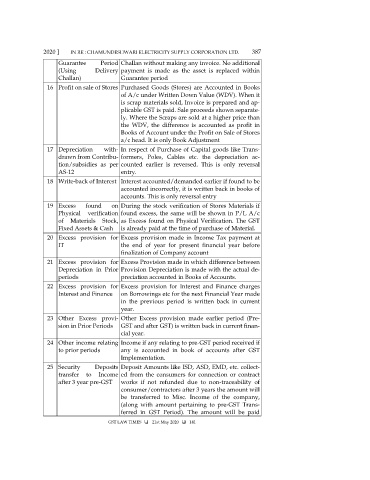

2020 ] IN RE : CHAMUNDESHWARI ELECTRICITY SUPPLY CORPORATION LTD. 387

Guarantee Period Challan without making any invoice. No additional

(Using Delivery payment is made as the asset is replaced within

Challan) Guarantee period

16 Profit on sale of Stores Purchased Goods (Stores) are Accounted in Books

of A/c under Written Down Value (WDV). When it

is scrap materials sold, Invoice is prepared and ap-

plicable GST is paid. Sale proceeds shown separate-

ly. Where the Scraps are sold at a higher price than

the WDV, the difference is accounted as profit in

Books of Account under the Profit on Sale of Stores

a/c head. It is only Book Adjustment

17 Depreciation with- In respect of Purchase of Capital goods like Trans-

drawn from Contribu- formers, Poles, Cables etc. the depreciation ac-

tion/subsidies as per counted earlier is reversed. This is only reversal

AS-12 entry.

18 Write-back of Interest Interest accounted/demanded earlier if found to be

accounted incorrectly, it is written back in books of

accounts. This is only reversal entry

19 Excess found on During the stock verification of Stores Materials if

Physical verification found excess, the same will be shown in P/L A/c

of Materials Stock, as Excess found on Physical Verification. The GST

Fixed Assets & Cash is already paid at the time of purchase of Material.

20 Excess provision for Excess provision made in Income Tax payment at

IT the end of year for present financial year before

finalization of Company account

21 Excess provision for Excess Provision made in which difference between

Depreciation in Prior Provision Depreciation is made with the actual de-

periods preciation accounted in Books of Accounts.

22 Excess provision for Excess provision for Interest and Finance charges

Interest and Finance on Borrowings etc for the next Financial Year made

in the previous period is written back in current

year.

23 Other Excess provi- Other Excess provision made earlier period (Pre-

sion in Prior Periods GST and after GST) is written back in current finan-

cial year.

24 Other income relating Income if any relating to pre-GST period received if

to prior periods any is accounted in book of accounts after GST

Implementation.

25 Security Deposits Deposit Amounts like ISD, ASD, EMD, etc. collect-

transfer to Income ed from the consumers for connection or contract

after 3 year pre-GST works if not refunded due to non-traceability of

consumer/contractors after 3 years the amount will

be transferred to Misc. Income of the company,

(along with amount pertaining to pre-GST Trans-

ferred in GST Period). The amount will be paid

GST LAW TIMES 21st May 2020 141