Page 161 - GSTL_21st May 2020_Vol 36_Part 3

P. 161

2020 ] IN RE : SAN ENGINEERING & LOCOMOTIVE CO. LTD. 407

Installation and commissioning invoice can be only raised after ob-

taining confirmation from the customer that the Installation and

Commissioning has been completed and a Completion Certificate to

that effect has been issued.

4. The applicant furnishes some facts relevant to the stated activity.

(a) The applicant states that he is engaged in manufacture of power

packs classifiable under HSN Code Chapter 86 and also in activity

of installation and commissioning of the same.

(b) The applicant has been issued with purchase Order Bearing No.

08/16/2730/1838/F, dated 5-11-2016 by M/s. Integral Coach Facto-

ry, Chennai to supply “twin power pack with underslung engine

and hydraulic transmission and commissioning/installation of the

same in High Speed Self Propelled Accident Relief Train (HS

SPART)”. As per the said purchase order, the applicant was re-

quired to supply 18 numbers of Power Pack to M/s. Integral Coach

Factory, Chennai and also to install/commission the same in HS

SPART. The applicant states that he has supplied and installed

some of the Power Packs in HS SPART during the Excise/Service

Tax regime and remaining units of Power Packs during GST regime.

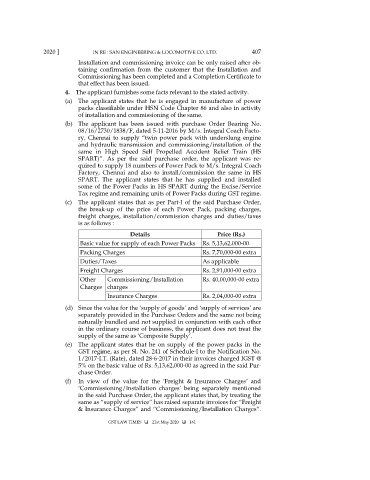

(c) The applicant states that as per Part-I of the said Purchase Order,

the break-up of the price of each Power Pack, packing charges,

freight charges, installation/commission charges and duties/taxes

is as follows :

Details Price (Rs.)

Basic value for supply of each Power Packs Rs. 5,13,62,000-00

Packing Charges Rs. 7,70,000-00 extra

Duties/Taxes As applicable

Freight Charges Rs. 2,91,000-00 extra

Other Commissioning/Installation Rs. 40,00,000-00 extra

Charges charges

Insurance Charges Rs. 2,04,000-00 extra

(d) Since the value for the ‘supply of goods’ and ‘supply of services’ are

separately provided in the Purchase Orders and the same not being

naturally bundled and not supplied in conjunction with each other

in the ordinary course of business, the applicant does not treat the

supply of the same as ‘Composite Supply’.

(e) The applicant states that he on supply of the power packs in the

GST regime, as per Sl. No. 241 of Schedule-I to the Notification No.

1/2017-I.T. (Rate), dated 28-6-2017 in their invoices charged IGST @

5% on the basic value of Rs. 5,13,62,000-00 as agreed in the said Pur-

chase Order.

(f) In view of the value for the ‘Freight & Insurance Charges’ and

‘Commissioning/Installation charges’ being separately mentioned

in the said Purchase Order, the applicant states that, by treating the

same as “supply of service” has raised separate invoices for “Freight

& Insurance Charges” and “Commissioning/Installation Charges”.

GST LAW TIMES 21st May 2020 161