Page 156 - GSTL_21st May 2020_Vol 36_Part 3

P. 156

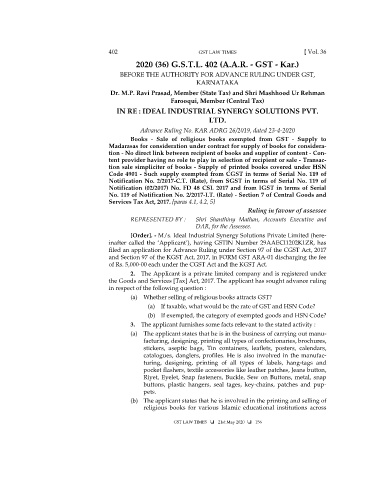

402 GST LAW TIMES [ Vol. 36

2020 (36) G.S.T.L. 402 (A.A.R. - GST - Kar.)

BEFORE THE AUTHORITY FOR ADVANCE RULING UNDER GST,

KARNATAKA

Dr. M.P. Ravi Prasad, Member (State Tax) and Shri Mashhood Ur Rehman

Farooqui, Member (Central Tax)

IN RE : IDEAL INDUSTRIAL SYNERGY SOLUTIONS PVT.

LTD.

Advance Ruling No. KAR ADRG 26/2019, dated 23-4-2020

Books - Sale of religious books exempted from GST - Supply to

Madarasas for consideration under contract for supply of books for considera-

tion - No direct link between recipient of books and supplier of content - Con-

tent provider having no role to play in selection of recipient or sale - Transac-

tion sale simpliciter of books - Supply of printed books covered under HSN

Code 4901 - Such supply exempted from CGST in terms of Serial No. 119 of

Notification No. 2/2017-C.T. (Rate), from SGST in terms of Serial No. 119 of

Notification (02/2017) No. FD 48 CSL 2017 and from IGST in terms of Serial

No. 119 of Notification No. 2/2017-I.T. (Rate) - Section 7 of Central Goods and

Services Tax Act, 2017. [paras 4.1, 4.2, 5]

Ruling in favour of assessee

REPRESENTED BY : Shri Shanthiny Mathan, Accounts Executive and

DAR, for the Assessee.

[Order]. - M/s. Ideal Industrial Synergy Solutions Private Limited (here-

inafter called the ‘Applicant’), having GSTIN Number 29AAECI1202K1ZR, has

filed an application for Advance Ruling under Section 97 of the CGST Act, 2017

and Section 97 of the KGST Act, 2017, in FORM GST ARA-01 discharging the fee

of Rs. 5,000-00 each under the CGST Act and the KGST Act.

2. The Applicant is a private limited company and is registered under

the Goods and Services [Tax] Act, 2017. The applicant has sought advance ruling

in respect of the following question :

(a) Whether selling of religious books attracts GST?

(a) If taxable, what would be the rate of GST and HSN Code?

(b) If exempted, the category of exempted goods and HSN Code?

3. The applicant furnishes some facts relevant to the stated activity :

(a) The applicant states that he is in the business of carrying out manu-

facturing, designing, printing all types of confectionaries, brochures,

stickers, aseptic bags, Tin containers, leaflets, posters, calendars,

catalogues, danglers, profiles. He is also involved in the manufac-

turing, designing, printing of all types of labels, hang-tags and

pocket flashers, textile accessories like leather patches, Jeans button,

Riyet, Eyelet, Snap fasteners, Buckle, Sew on Buttons, metal, snap

buttons, plastic hangers, seal tages, key-chains, patches and pup-

pets.

(b) The applicant states that he is involved in the printing and selling of

religious books for various Islamic educational institutions across

GST LAW TIMES 21st May 2020 156