Page 224 - GSTL_21st May 2020_Vol 36_Part 3

P. 224

470 GST LAW TIMES [ Vol. 36

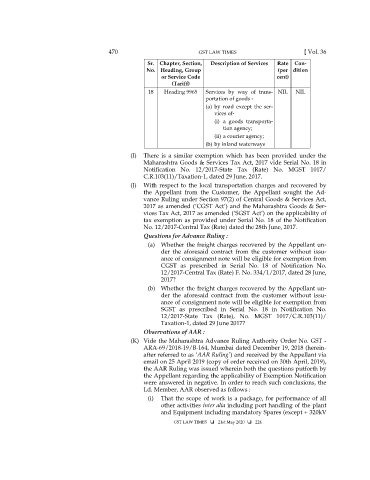

Sr. Chapter, Section, Description of Services Rate Con-

No. Heading, Group (per dition

or Service Code cent)

(Tariff)

18 Heading 9965 Services by way of trans- NIL NIL

portation of goods -

(a) by road except the ser-

vices of-

(i) a goods transporta-

tion agency;

(ii) a courier agency;

(b) by inland waterways

(I) There is a similar exemption which has been provided under the

Maharashtra Goods & Services Tax Act, 2017 vide Serial No. 18 in

Notification No. 12/2017-State Tax (Rate) No. MGST 1017/

C.R.103(11)/Taxation-1, dated 29 June, 2017.

(J) With respect to the local transportation charges and recovered by

the Appellant from the Customer, the Appellant sought the Ad-

vance Ruling under Section 97(2) of Central Goods & Services Act,

2017 as amended (‘CGST Act’) and the Maharashtra Goods & Ser-

vices Tax Act, 2017 as amended (‘SGST Act’) on the applicability of

tax exemption as provided under Serial No. 18 of the Notification

No. 12/2017-Central Tax (Rate) dated the 28th June, 2017.

Questions for Advance Ruling :

(a) Whether the freight charges recovered by the Appellant un-

der the aforesaid contract from the customer without issu-

ance of consignment note will be eligible for exemption from

CGST as prescribed in Serial No. 18 of Notification No.

12/2017-Central Tax (Rate) F. No. 334/1/2017, dated 28 June,

2017?

(b) Whether the freight charges recovered by the Appellant un-

der the aforesaid contract from the customer without issu-

ance of consignment note will be eligible for exemption from

SGST as prescribed in Serial No. 18 in Notification No.

12/2017-State Tax (Rate), No. MGST 1017/C.R.103(11)/

Taxation-1, dated 29 June 2017?

Observations of AAR :

(K) Vide the Maharashtra Advance Ruling Authority Order No. GST -

ARA-69/2018-19/B-164, Mumbai dated December 19, 2018 (herein-

after referred to as ‘AAR Ruling’) and received by the Appellant via

email on 25 April 2019 (copy of order received on 30th April, 2019),

the AAR Ruling was issued wherein both the questions putforth by

the Appellant regarding the applicability of Exemption Notification

were answered in negative. In order to reach such conclusions, the

Ld. Member, AAR observed as follows :

(i) That the scope of work is a package, for performance of all

other activities inter alia including port handling of the plant

and Equipment including mandatory Spares (except + 320kV

GST LAW TIMES 21st May 2020 224