Page 219 - GSTL_21st May 2020_Vol 36_Part 3

P. 219

2020 ] IN RE : SRISAI LUXURIOUS STAY LLP 465

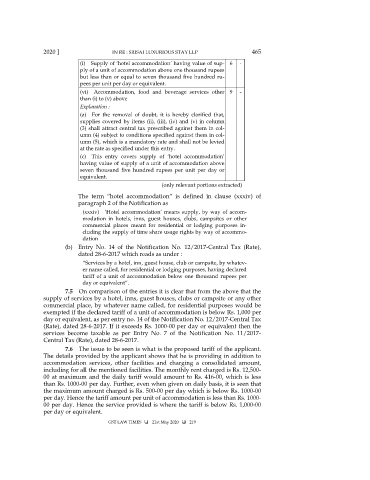

(i) Supply of ‘hotel accommodation’ having value of sup- 6 -

ply of a unit of accommodation above one thousand rupees

but less than or equal to seven thousand five hundred ru-

pees per unit per day or equivalent.

(vi) Accommodation, food and beverage services other 9 -

than (i) to (v) above

Explanation :

(a) For the removal of doubt, it is hereby clarified that,

supplies covered by items (ii), (iii), (iv) and (v) in column

(3) shall attract central tax prescribed against them in col-

umn (4) subject to conditions specified against them in col-

umn (5), which is a mandatory rate and shall not be levied

at the rate as specified under this entry.

(c) This entry covers supply of ‘hotel accommodation’

having value of supply of a unit of accommodation above

seven thousand five hundred rupees per unit per day or

equivalent.

(only relevant portions extracted)

The term “hotel accommodation” is defined in clause (xxxiv) of

paragraph 2 of the Notification as

(xxxiv) ‘Hotel accommodation’ means supply, by way of accom-

modation in hotels, inns, guest houses, clubs, campsites or other

commercial places meant for residential or lodging purposes in-

cluding the supply of time share usage rights by way of accommo-

dation

(b) Entry No. 14 of the Notification No. 12/2017-Central Tax (Rate),

dated 28-6-2017 which reads as under :

“Services by a hotel, inn, guest house, club or campsite, by whatev-

er name called, for residential or lodging purposes, having declared

tariff of a unit of accommodation below one thousand rupees per

day or equivalent”.

7.5 On comparison of the entries it is clear that from the above that the

supply of services by a hotel, inns, guest houses, clubs or campsite or any other

commercial place, by whatever name called, for residential purposes would be

exempted if the declared tariff of a unit of accommodation is below Rs. 1,000 per

day or equivalent, as per entry no. 14 of the Notification No. 12/2017-Central Tax

(Rate), dated 28-6-2017. If it exceeds Rs. 1000-00 per day or equivalent then the

services become taxable as per Entry No. 7 of the Notification No. 11/2017-

Central Tax (Rate), dated 28-6-2017.

7.6 The issue to be seen is what is the proposed tariff of the applicant.

The details provided by the applicant shows that he is providing in addition to

accommodation services, other facilities and charging a consolidated amount,

including for all the mentioned facilities. The monthly rent charged is Rs. 12,500-

00 at maximum and the daily tariff would amount to Rs. 416-00, which is less

than Rs. 1000-00 per day. Further, even when given on daily basis, it is seen that

the maximum amount charged is Rs. 500-00 per day which is below Rs. 1000-00

per day. Hence the tariff amount per unit of accommodation is less than Rs. 1000-

00 per day. Hence the service provided is where the tariff is below Rs. 1,000-00

per day or equivalent.

GST LAW TIMES 21st May 2020 219