Page 217 - GSTL_21st May 2020_Vol 36_Part 3

P. 217

2020 ] IN RE : SRISAI LUXURIOUS STAY LLP 463

(3) Whether the said notification would be applicable if LLP decides to

charge additional charges for the extra-facilities opted by the inhab-

itants in addition to the facilities that are currently included in the

tariff received by the inhabitants but the overall price would be less

than the present exemption limit of Rs. 1000 per day per Unit?

4. The applicant furnishes some facts relevant to the stated activity.

(a) The applicant states that they were set up as a Limited Liability

Partnership under the provisions of the Limited Liability Partner-

ship Act, 2008 in the State of Karnataka under the jurisdiction of the

Registrar of Companies, Bangalore and has been allotted LLPN AQ-

6204 on 20-9-2019.

(b) The applicant was incorporated with two designated partners and

established with the main objective to carry on, within India, the

business of developing, running, maintaining, operating, setting up,

owning, dealing in, buying, selling, renting, subletting, and manag-

ing paying guest accommodations, service apartments, flats aimed

to suit all type of customers by whatever name called.

(c) The LLP has been specifically focused on provision of Boarding and

Lodging facilities both on monthly and daily tariffs for inhabitants

and also ancillary services to the above only to the inhabitants as

states below :

(a) Meals which includes breakfast, lunch and dinner

(b) Fully furnished rooms

(c) Round the clock security guards at the premises

(d) Housekeeping facilities

(e) Washing Machine facilities

(f) Television in each room

(g) Internet facilities (WIFI available)

(h) Vehicle parking facilities

(d) All the above mentioned facilities are included in the tariffs that

they charge from the inhabitants and the tariff rates are as below :

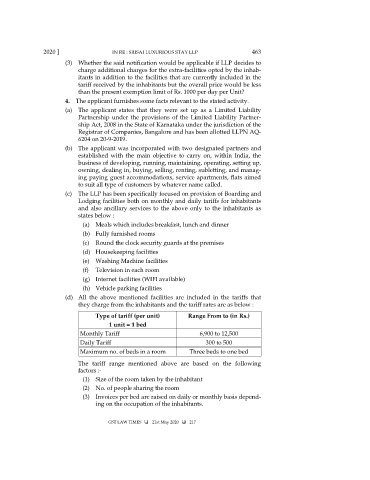

Type of tariff (per unit) Range From to (in Rs.)

1 unit = 1 bed

Monthly Tariff 6,900 to 12,500

Daily Tariff 300 to 500

Maximum no. of beds in a room Three beds to one bed

The tariff range mentioned above are based on the following

factors :-

(1) Size of the room taken by the inhabitant

(2) No. of people sharing the room

(3) Invoices per bed are raised on daily or monthly basis depend-

ing on the occupation of the inhabitants.

GST LAW TIMES 21st May 2020 217