Page 216 - GSTL_21st May 2020_Vol 36_Part 3

P. 216

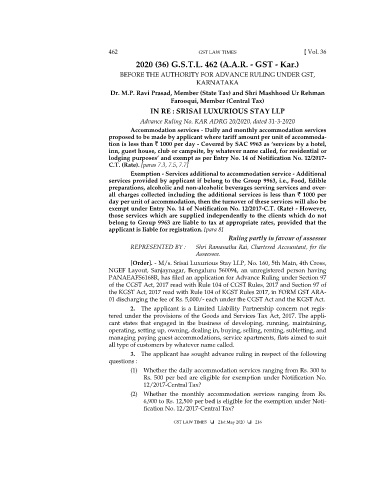

462 GST LAW TIMES [ Vol. 36

2020 (36) G.S.T.L. 462 (A.A.R. - GST - Kar.)

BEFORE THE AUTHORITY FOR ADVANCE RULING UNDER GST,

KARNATAKA

Dr. M.P. Ravi Prasad, Member (State Tax) and Shri Mashhood Ur Rehman

Farooqui, Member (Central Tax)

IN RE : SRISAI LUXURIOUS STAY LLP

Advance Ruling No. KAR ADRG 20/2020, dated 31-3-2020

Accommodation services - Daily and monthly accommodation services

proposed to be made by applicant where tariff amount per unit of accommoda-

tion is less than ` 1000 per day - Covered by SAC 9963 as ‘services by a hotel,

inn, guest house, club or campsite, by whatever name called, for residential or

lodging purposes’ and exempt as per Entry No. 14 of Notification No. 12/2017-

C.T. (Rate). [paras 7.3, 7.5, 7.7]

Exemption - Services additional to accommodation service - Additional

services provided by applicant if belong to the Group 9963, i.e., Food, Edible

preparations, alcoholic and non-alcoholic beverages serving services and over-

all charges collected including the additional services is less than ` 1000 per

day per unit of accommodation, then the turnover of these services will also be

exempt under Entry No. 14 of Notification No. 12/2017-C.T. (Rate) - However,

those services which are supplied independently to the clients which do not

belong to Group 9963 are liable to tax at appropriate rates, provided that the

applicant is liable for registration. [para 8]

Ruling partly in favour of assessee

REPRESENTED BY : Shri Ramanatha Rai, Chartered Accountant, for the

Asseessee.

[Order]. - M/s. Srisai Luxurious Stay LLP, No. 160, 5th Main, 4th Cross,

NGEF Layout, Sanjaynagar, Bengaluru 560094, an unregistered person having

PANAEAFS6168R, has filed an application for Advance Ruling under Section 97

of the CGST Act, 2017 read with Rule 104 of CGST Rules, 2017 and Section 97 of

the KGST Act, 2017 read with Rule 104 of KGST Rules 2017, in FORM GST ARA-

01 discharging the fee of Rs. 5,000/- each under the CGST Act and the KGST Act.

2. The applicant is a Limited Liability Partnership concern not regis-

tered under the provisions of the Goods and Services Tax Act, 2017. The appli-

cant states that engaged in the business of developing, running, maintaining,

operating, setting up, owning, dealing in, buying, selling, renting, subletting, and

managing paying guest accommodations, service apartments, flats aimed to suit

all type of customers by whatever name called.

3. The applicant has sought advance ruling in respect of the following

questions :

(1) Whether the daily accommodation services ranging from Rs. 300 to

Rs. 500 per bed are eligible for exemption under Notification No.

12/2017-Central Tax?

(2) Whether the monthly accommodation services ranging from Rs.

6,900 to Rs. 12,500 per bed is eligible for the exemption under Noti-

fication No. 12/2017-Central Tax?

GST LAW TIMES 21st May 2020 216