Page 97 - GSTL_21st May 2020_Vol 36_Part 3

P. 97

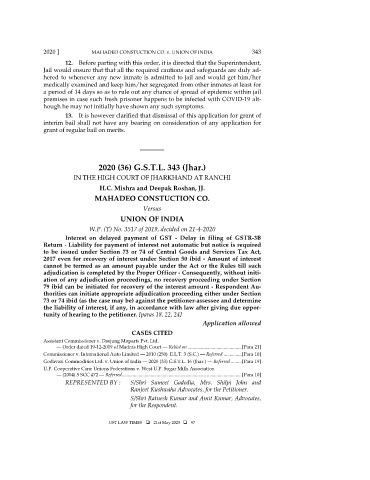

2020 ] MAHADEO CONSTUCTION CO. v. UNION OF INDIA 343

12. Before parting with this order, it is directed that the Superintendent,

Jail would ensure that that all the required cautions and safeguards are duly ad-

hered to whenever any new inmate is admitted to jail and would get him/her

medically examined and keep him/her segregated from other inmates at least for

a period of 14 days so as to rule out any chance of spread of epidemic within jail

premises in case such fresh prisoner happens to be infected with COVID-19 alt-

hough he may not initially have shown any such symptoms.

13. It is however clarified that dismissal of this application for grant of

interim bail shall not have any bearing on consideration of any application for

grant of regular bail on merits.

________

2020 (36) G.S.T.L. 343 (Jhar.)

IN THE HIGH COURT OF JHARKHAND AT RANCHI

H.C. Mishra and Deepak Roshan, JJ.

MAHADEO CONSTUCTION CO.

Versus

UNION OF INDIA

W.P. (T) No. 3517 of 2019, decided on 21-4-2020

Interest on delayed payment of GST - Delay in filing of GSTR-3B

Return - Liability for payment of interest not automatic but notice is required

to be issued under Section 73 or 74 of Central Goods and Services Tax Act,

2017 even for recovery of interest under Section 50 ibid - Amount of interest

cannot be termed as an amount payable under the Act or the Rules till such

adjudication is completed by the Proper Officer - Consequently, without initi-

ation of any adjudication proceedings, no recovery proceeding under Section

79 ibid can be initiated for recovery of the interest amount - Respondent Au-

thorities can initiate appropriate adjudication proceeding either under Section

73 or 74 ibid (as the case may be) against the petitioner-assessee and determine

the liability of interest, if any, in accordance with law after giving due oppor-

tunity of hearing to the petitioner. [paras 18, 22, 24]

Application allowed

CASES CITED

Assistant Commissioner v. Daejung Moparts Pvt. Ltd.

— Order dated 19-12-2019 of Madras High Court — Relied on ............................................. [Para 21]

Commissioner v. International Auto Limited — 2010 (250) E.L.T. 3 (S.C.) — Referred ............... [Para 10]

Godavari Commodities Ltd. v. Union of India — 2020 (33) G.S.T.L. 16 (Jhar.) — Referred ......... [Para 19]

U.P. Cooperative Cane Unions Federations v. West U.P. Sugar Mills Association

— (2004) 5 SCC 472 — Referred .................................................................................................... [Para 10]

REPRESENTED BY : S/Shri Sumeet Gadodia, Mrs. Shilpi John and

Ranjeet Kushwaha Advocates, for the Petitioner.

S/Shri Ratnesh Kumar and Amit Kumar, Advocates,

for the Respondent.

GST LAW TIMES 21st May 2020 97