Page 100 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 100

546 GST LAW TIMES [ Vol. 36

no tax has been charged on the supplies by the DTA unit to SEZ unit, there

is no question of declaration of non-availment of ITC. Thus, on the basis of

such declaration the department is well-positioned to check the duplicity of

refund claim.

We would like to further throw light on third provision to Rule 89(1) of

Andhra Pradesh Goods and Services Tax Rules, 2017, which read as

follows :-

“Provided also that in respect of supplies regarded as deemed ex-

ports, the application may be filed by -

(a) The recipient of deemed export supplies; or

(b) The supplier of deemed export supplies in cases where the re-

cipient does not avail of input tax credit on such supplies and

furnishes an undertaking to the effect that the supplier may

claim the refund.”

As per the above provision, the facility to claim refund has been given both

to the recipient and the supplier of deemed export supplies. In case the

supplier of deemed export supplies, exercises his option to claim refund of

taxes paid on its outward supplies [then] it has to take declarations from

the recipient that no input tax credit has been availed by the recipient of

supplies. Further, there are provisions in law against any person commit-

ting offence of wrongful declaration and thus, the Revenue Department has

appropriate safeguard regarding any wrongful declaration.

On the basis of the provisions of law stated in foregoing paragraphs, the

appellant humbly submit before the Ld. Appellate Joint Commissioner that

the SEZ unit can claim the refund of unutilized Input Tax Credit.

2.3 The details of parties to whom taxes has been paid during the period

for which this appeal has been filed and the appellant has claimed the input

of taxes paid on the procurement of supplies from DTA units are :-

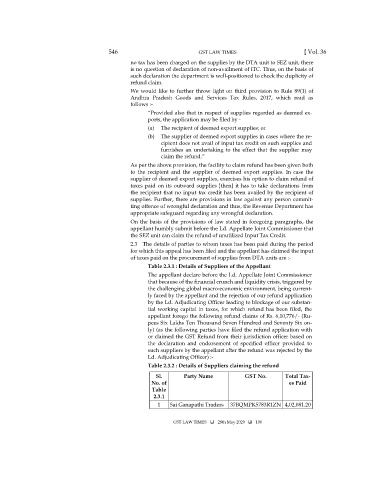

Table 2.3.1 : Details of Suppliers of the Appellant

The appellant declare before the Ld. Appellate Joint Commissioner

that because of the financial crunch and liquidity crisis, triggered by

the challenging global macro-economic environment, being current-

ly faced by the appellant and the rejection of our refund application

by the Ld. Adjudicating Officer leading to blockage of our substan-

tial working capital in taxes, for which refund has been filed, the

appellant forego the following refund claims of Rs. 6,10,776/- (Ru-

pees Six Lakhs Ten Thousand Seven Hundred and Seventy Six on-

ly) (as the following parties have filed the refund application with

or claimed the GST Refund from their jurisdiction officer based on

the declaration and endorsement of specified officer provided to

such suppliers by the appellant after the refund was rejected by the

Ld. Adjudicating Officer) :-

Table 2.3.2 : Details of Suppliers claiming the refund

Sl. Party Name GST No. Total Tax-

No. of es Paid

Table

2.3.1

1 Sai Ganapathi Traders 37BQMPK5783R1ZN 4,02,081.20

GST LAW TIMES 28th May 2020 100