Page 110 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 110

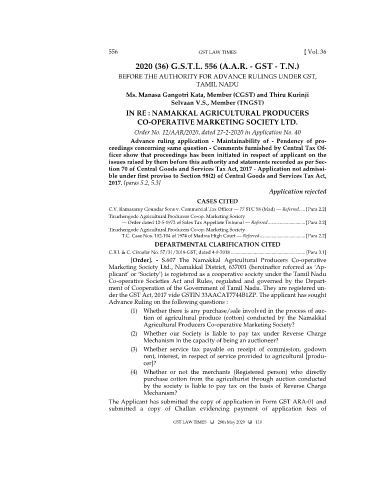

556 GST LAW TIMES [ Vol. 36

2020 (36) G.S.T.L. 556 (A.A.R. - GST - T.N.)

BEFORE THE AUTHORITY FOR ADVANCE RULINGS UNDER GST,

TAMIL NADU

Ms. Manasa Gangotri Kata, Member (CGST) and Thiru Kurinji

Selvaan V.S., Member (TNGST)

IN RE : NAMAKKAL AGRICULTURAL PRODUCERS CO-OPERATIVE MARKETING

IN RE : NAMAKKAL AGRICULTURAL PRODUCERS

CO-OPERATIVE MARKETING SOCIETY LTD.

IN RE : NAMAKKAL AGRICULTURAL PRODUCERS CO-OPERATIVE MARKETING

Order No. 12/AAR/2020, dated 27-2-2020 in Application No. 40

Advance ruling application - Maintainability of - Pendency of pro-

ceedings concerning same question - Comments furnished by Central Tax Of-

ficer show that proceedings has been initiated in respect of applicant on the

issues raised by them before this authority and statements recorded as per Sec-

tion 70 of Central Goods and Services Tax Act, 2017 - Application not admissi-

ble under first proviso to Section 98(2) of Central Goods and Services Tax Act,

2017. [paras 5.2, 5.3]

Application rejected

CASES CITED

C.V. Ramasamy Goundar Sons v. Commercial Tax Officer — 77 STC 58 (Mad) — Referred ..... [Para 2.2]

Tiruchengode Agricultural Producers Co-op. Marketing Society

— Order dated 12-5-1972 of Sales Tax Appellate Tribunal — Referred ............................... [Para 2.2]

Tiruchengode Agricultural Producers Co-op. Marketing Society

T.C. Case Nos. 102-104 of 1974 of Madras High Court — Referred ...................................... [Para 2.2]

DEPARTMENTAL CLARIFICATION CITED

C.B.I. & C. Circular No. 57/31/2018-GST, dated 4-9-2018 .............................................................. [Para 3.1]

[Order]. - S.607 The Namakkal Agricultural Producers Co-operative

Marketing Society Ltd., Namakkal District, 637001 (hereinafter referred as ‘Ap-

plicant’ or ‘Society’) is registered as a cooperative society under the Tamil Nadu

Co-operative Societies Act and Rules, regulated and governed by the Depart-

ment of Cooperation of the Government of Tamil Nadu. They are registered un-

der the GST Act, 2017 vide GSTIN 33AACAT7744B1ZP. The applicant has sought

Advance Ruling on the following questions :

(1) Whether there is any purchase/sale involved in the process of auc-

tion of agricultural produce (cotton) conducted by the Namakkal

Agricultural Producers Co-operative Marketing Society?

(2) Whether our Society is liable to pay tax under Reverse Charge

Mechanism in the capacity of being an auctioneer?

(3) Whether service tax payable on receipt of commission, godown

rent, interest, in respect of service provided to agricultural [produ-

cer]?

(4) Whether or not the merchants (Registered person) who directly

purchase cotton from the agriculturist through auction conducted

by the society is liable to pay tax on the basis of Reverse Charge

Mechanism?

The Applicant has submitted the copy of application in Form GST ARA-01 and

submitted a copy of Challan evidencing payment of application fees of

GST LAW TIMES 28th May 2020 110