Page 177 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 177

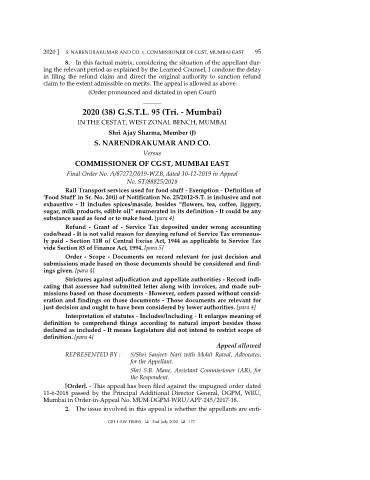

2020 ] S. NARENDRAKUMAR AND CO. v. COMMISSIONER OF CGST, MUMBAI EAST 95

8. In this factual matrix, considering the situation of the appellant dur-

ing the relevant period as explained by the Learned Counsel, I condone the delay

in filing the refund claim and direct the original authority to sanction refund

claim to the extent admissible on merits. The appeal is allowed as above.

(Order pronounced and dictated in open Court)

______

2020 (38) G.S.T.L. 95 (Tri. - Mumbai)

IN THE CESTAT, WEST ZONAL BENCH, MUMBAI

Shri Ajay Sharma, Member (J)

S. NARENDRAKUMAR AND CO.

Versus

COMMISSIONER OF CGST, MUMBAI EAST

Final Order No. A/87272/2019-WZB, dated 10-12-2019 in Appeal

No. ST/88825/2018

Rail Transport services used for food stuff - Exemption - Definition of

‘Food Stuff’ in Sr. No. 20(i) of Notification No. 25/2012-S.T. is inclusive and not

exhaustive - It includes spices/masale, besides “flowers, tea, coffee, jiggery,

sugar, milk products, edible oil” enumerated in its definition - It could be any

substance used as food or to make food. [para 4]

Refund - Grant of - Service Tax deposited under wrong accounting

code/head - It is not valid reason for denying refund of Service Tax erroneous-

ly paid - Section 11B of Central Excise Act, 1944 as applicable to Service Tax

vide Section 83 of Finance Act, 1994. [para 5]

Order - Scope - Documents on record relevant for just decision and

submissions made based on those documents should be considered and find-

ings given. [para 4]

Strictures against adjudication and appellate authorities - Record indi-

cating that assessee had submitted letter along with invoices, and made sub-

missions based on those documents - However, orders passed without consid-

eration and findings on those documents - Those documents are relevant for

just decision and ought to have been considered by lower authorities. [para 4]

Interpretation of statutes - Includes/Including - It enlarges meaning of

definition to comprehend things according to natural import besides those

declared as included - It means Legislature did not intend to restrict scope of

definition. [para 4]

Appeal allowed

REPRESENTED BY : S/Shri Sanjeev Nari with Mohit Rawal, Advocates,

for the Appellant.

Shri S.B. Mane, Assistant Commissioner (AR), for

the Respondent.

[Order]. - This appeal has been filed against the impugned order dated

11-6-2018 passed by the Principal Additional Director General, DGPM, WRU,

Mumbai in Order-in-Appeal No. MUM-DGPM-WRU/APP-245/2017-18.

2. The issue involved in this appeal is whether the appellants are enti-

GST LAW TIMES 2nd July 2020 177