Page 180 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 180

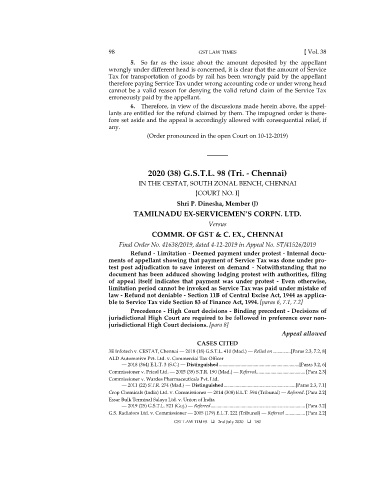

98 GST LAW TIMES [ Vol. 38

5. So far as the issue about the amount deposited by the appellant

wrongly under different head is concerned, it is clear that the amount of Service

Tax for transportation of goods by rail has been wrongly paid by the appellant

therefore paying Service Tax under wrong accounting code or under wrong head

cannot be a valid reason for denying the valid refund claim of the Service Tax

erroneously paid by the appellant.

6. Therefore, in view of the discussions made herein above, the appel-

lants are entitled for the refund claimed by them. The impugned order is there-

fore set aside and the appeal is accordingly allowed with consequential relief, if

any.

(Order pronounced in the open Court on 10-12-2019)

_______

2020 (38) G.S.T.L. 98 (Tri. - Chennai)

IN THE CESTAT, SOUTH ZONAL BENCH, CHENNAI

[COURT NO. I]

Shri P. Dinesha, Member (J)

TAMILNADU EX-SERVICEMEN’S CORPN. LTD.

Versus

COMMR. OF GST & C. EX., CHENNAI

COMMR. OF GST & C. EX.

Final Order No. 41638/2019, dated 4-12-2019 in Appeal No. ST/41526/2019

Refund - Limitation - Deemed payment under protest - Internal docu-

ments of appellant showing that payment of Service Tax was done under pro-

test post adjudication to save interest on demand - Notwithstanding that no

document has been adduced showing lodging protest with authorities, filing

of appeal itself indicates that payment was under protest - Even otherwise,

limitation period cannot be invoked as Service Tax was paid under mistake of

law - Refund not deniable - Section 11B of Central Excise Act, 1944 as applica-

ble to Service Tax vide Section 83 of Finance Act, 1994. [paras 6, 7.1, 7.2]

Precedence - High Court decisions - Binding precedent - Decisions of

jurisdictional High Court are required to be followed in preference over non-

jurisdictional High Court decisions. [para 8]

Appeal allowed

CASES CITED

3E Infotech v. CESTAT, Chennai — 2018 (18) G.S.T.L. 410 (Mad.) — Relied on ............... [Paras 2.3, 7.2, 8]

ALD Automotive Pvt. Ltd. v. Commercial Tax Officer

— 2018 (364) E.L.T. 3 (S.C.) — Distinguished ................................................................... [Paras 3.2, 6]

Commissioner v. Pricol Ltd. — 2015 (39) S.T.R. 190 (Mad.) — Referred......................................... [Para 2.3]

Commissioner v. Wardes Pharmaceuticals Pvt. Ltd.

— 2011 (22) S.T.R. 274 (Mad.) — Distinguished ............................................................ [Paras 2.3, 7.1]

Crop Chemicals (India) Ltd. v. Commissioner — 2014 (308) E.L.T. 594 (Tribunal) — Referred . [Para 2.2]

Essar Bulk Terminal Salaya Ltd. v. Union of India

— 2019 (25) G.S.T.L. 521 (Guj.) — Referred ............................................................................... [Para 3.2]

G.S. Radiators Ltd. v. Commissioner — 2005 (179) E.L.T. 222 (Tribunal) — Referred ................. [Para 2.2]

GST LAW TIMES 2nd July 2020 180