Page 183 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 183

2020 ] BHARAT MINES & MINERALS v. COMMR. OF CGST, DEHRADUN 101

and were based mainly on facts relating to the first respondent-assessee, we

do not find any question of law, much less substantial question of law to be

entertained in this appeal. We, therefore, do not find any merits to entertain

this appeal. The appeal fails and the same is dismissed. No costs. Conse-

quently, M.P. No. 1 of 2010 is also dismissed.”

The same may not apply here since, there is Board resolution - obviously volun-

tary, though the word ‘protest’ is used, but nevertheless, the fact remains that the

tax was paid to arrest interest. In any case, filing of appeal itself is enough to in-

dicate that the duty was paid under protest.

7.2 Further, the Hon’ble jurisdictional High Court in the case of M/s. 3E

Infotech (supra) has categorically held that even when Service Tax was paid un-

der mistake of law, the period of limitation cannot be invoked to deny the re-

fund.

8. In the light of jurisdictional High Court decisions which are binding

on this Tribunal at Chennai, the same are required to be followed here over non-

jurisdictional High Court decisions.

9. In view of the above, the appeal is allowed with consequential bene-

fits, if any, as per law.

(Order pronounced in the open Court on 4-12-2019)

_______

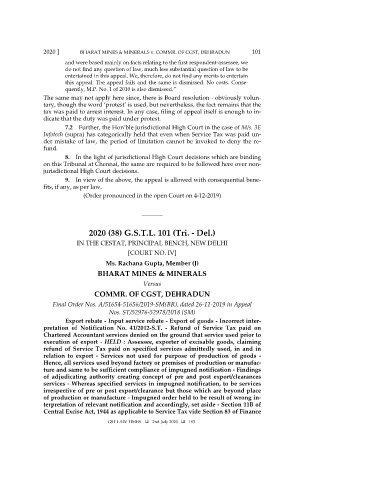

2020 (38) G.S.T.L. 101 (Tri. - Del.)

IN THE CESTAT, PRINCIPAL BENCH, NEW DELHI

[COURT NO. IV]

Ms. Rachana Gupta, Member (J)

BHARAT MINES & MINERALS

Versus

COMMR. OF CGST, DEHRADUN

Final Order Nos. A/51654-51656/2019-SM(BR), dated 26-11-2019 in Appeal

Nos. ST/52976-52978/2018 (SM)

Export rebate - Input service rebate - Export of goods - Incorrect inter-

pretation of Notification No. 41/2012-S.T. - Refund of Service Tax paid on

Chartered Accountant services denied on the ground that service used prior to

execution of export - HELD : Assessee, exporter of excisable goods, claiming

refund of Service Tax paid on specified services admittedly used, in and in

relation to export - Services not used for purpose of production of goods -

Hence, all services used beyond factory or premises of production or manufac-

ture and same to be sufficient compliance of impugned notification - Findings

of adjudicating authority creating concept of pre and post export/clearances

services - Whereas specified services in impugned notification, to be services

irrespective of pre or post export/clearance but those which are beyond place

of production or manufacture - Impugned order held to be result of wrong in-

terpretation of relevant notification and accordingly, set aside - Section 11B of

Central Excise Act, 1944 as applicable to Service Tax vide Section 83 of Finance

GST LAW TIMES 2nd July 2020 183