Page 2 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 2

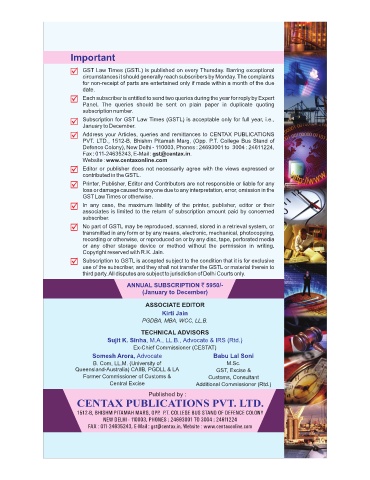

Important

* GST Law Times (GSTL) is published on every Thursday. Barring exceptional

circumstances it should generally reach subscribers by Monday. The complaints

for non-receipt of parts are entertained only if made within a month of the due

date.

* Each subscriber is entitled to send two queries during the year for reply by Expert

Panel. The queries should be sent on plain paper in duplicate quoting

subscription number.

* Subscription for GST Law Times (GSTL) is acceptable only for full year, i.e.,

January to December.

* Address your Articles, queries and remittances to CENTAX PUBLICATIONS

PVT. LTD., 1512-B, Bhishm Pitamah Marg, (Opp. P.T. College Bus Stand of

Defence Colony), New Delhi - 110003, Phones : 24693001 to 3004 : 24611224,

Fax : 011-24635243, E-Mail : gst@centax.in.

Website : www.centaxonline.com

* Editor or publisher does not necessarily agree with the views expressed or

contributed in the GSTL.

* Printer, Publisher, Editor and Contributors are not responsible or liable for any

loss or damage caused to anyone due to any interpretation, error, omission in the

GST Law Times or otherwise.

* In any case, the maximum liability of the printer, publisher, editor or their

associates is limited to the return of subscription amount paid by concerned

subscriber.

* No part of GSTL may be reproduced, scanned, stored in a retrieval system, or

transmitted in any form or by any means, electronic, mechanical, photocopying,

recording or otherwise, or reproduced on or by any disc, tape, perforated media

or any other storage device or method without the permission in writing.

Copyright reserved with R.K. Jain.

* Subscription to GSTL is accepted subject to the condition that it is for exclusive

use of the subscriber, and they shall not transfer the GSTL or material therein to

third party. All disputes are subject to jurisdiction of Delhi Courts only.

ANNUAL SUBSCRIPTION 5950/-`

(January to December)

ASSOCIATE EDITOR

Kirti Jain

PGDBA, MBA, WCC, LL.B.

TECHNICAL ADVISORS

Sujit K. Sinha, M.A., LL.B., Advocate & IRS (Rtd.)

Ex-Chief Commissioner (CESTAT)

Somesh Arora, Advocate Babu Lal Soni

B. Com, LL.M. (University of M.Sc.

Queensland-Australia) CAIIB, PGDLL & LA GST, Excise &

Former Commissioner of Customs & Customs, Consultant

Central Excise Additional Commissioner (Rtd.)

Published by :

1512-B, BHISHM PITAMAH MARG, OPP. P.T. COLLEGE BUS STAND OF DEFENCE COLONY

NEW DELHI - 110003, PHONES : 24693001 TO 3004 : 24611224

FAX : 011-24635243, E-Mail : gst@centax.in, Website : www.centaxonline.com