Page 7 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 7

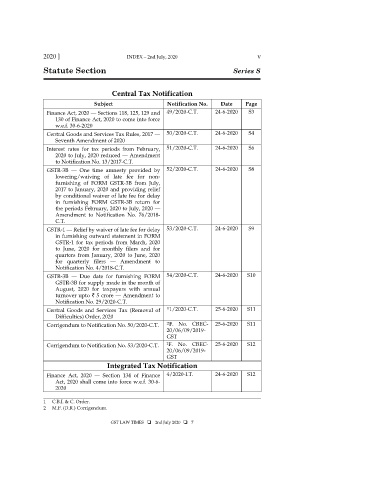

2020 ] INDEX – 2nd July, 2020 v

Statute Section Series S

Central Tax Notification

Subject Notification No. Date Page

Finance Act, 2020 — Sections 118, 125, 129 and 49/2020-C.T. 24-6-2020 S3

130 of Finance Act, 2020 to come into force

w.e.f. 30-6-2020

Central Goods and Services Tax Rules, 2017 — 50/2020-C.T. 24-6-2020 S4

Seventh Amendment of 2020

Interest rates for tax periods from February, 51/2020-C.T. 24-6-2020 S6

2020 to July, 2020 reduced — Amendment

to Notification No. 13/2017-C.T.

GSTR-3B — One time amnesty provided by 52/2020-C.T. 24-6-2020 S8

lowering/waiving of late fee for non-

furnishing of FORM GSTR-3B from July,

2017 to January, 2020 and providing relief

by conditional waiver of late fee for delay

in furnishing FORM GSTR-3B return for

the periods February, 2020 to July, 2020 —

Amendment to Notification No. 76/2018-

C.T.

GSTR-1 — Relief by waiver of late fee for delay 53/2020-C.T. 24-6-2020 S9

in furnishing outward statement in FORM

GSTR-1 for tax periods from March, 2020

to June, 2020 for monthly filers and for

quarters from January, 2020 to June, 2020

for quarterly filers — Amendment to

Notification No. 4/2018-C.T.

GSTR-3B — Due date for furnishing FORM 54/2020-C.T. 24-6-2020 S10

GSTR-3B for supply made in the month of

August, 2020 for taxpayers with annual

turnover upto ` 5 crore — Amendment to

Notification No. 29/2020-C.T.

Central Goods and Services Tax (Removal of 1 1/2020-C.T. 25-6-2020 S11

Difficulties) Order, 2020

Corrigendum to Notification No. 50/2020-C.T. 2 F. No. CBEC- 25-6-2020 S11

20/06/09/2019-

GST

Corrigendum to Notification No. 53/2020-C.T. 2 F. No. CBEC- 25-6-2020 S12

20/06/09/2019-

GST

Integrated Tax Notification

Finance Act, 2020 — Section 134 of Finance 4/2020-I.T. 24-6-2020 S12

Act, 2020 shall come into force w.e.f. 30-6-

2020

____________________________________________________________

1 C.B.I. & C. Order.

2 M.F. (D.R.) Corrigendum.

GST LAW TIMES 2nd July 2020 7