Page 68 - ELT_3rd_1st May 2020_Vol 372_Part

P. 68

N52 EXCISE LAW TIMES [ Vol. 372

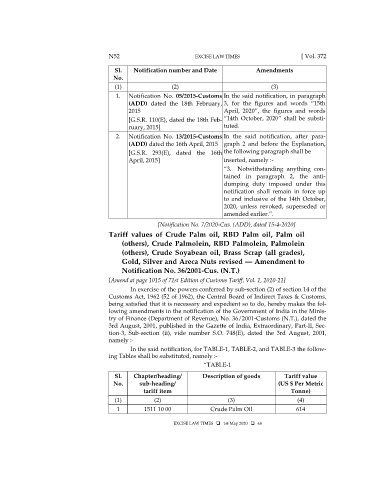

Sl. Notification number and Date Amendments

No.

(1) (2) (3)

1. Notification No. 05/2015-Customs In the said notification, in paragraph

(ADD) dated the 18th February, 3, for the figures and words “15th

2015 April, 2020”, the figures and words

[G.S.R. 110(E), dated the 18th Feb- “14th October, 2020” shall be substi-

ruary, 2015] tuted.

2. Notification No. 13/2015-Customs In the said notification, after para-

(ADD) dated the 16th April, 2015 graph 2 and before the Explanation,

[G.S.R. 293(E), dated the 16th the following paragraph shall be

April, 2015] inserted, namely :-

“3. Notwithstanding anything con-

tained in paragraph 2, the anti-

dumping duty imposed under this

notification shall remain in force up

to and inclusive of the 14th October,

2020, unless revoked, superseded or

amended earlier.”.

[Notification No. 7/2020-Cus. (ADD), dated 15-4-2020]

Tariff values of Crude Palm oil, RBD Palm oil, Palm oil

(others), Crude Palmolein, RBD Palmolein, Palmolein

(others), Crude Soyabean oil, Brass Scrap (all grades),

Gold, Silver and Areca Nuts revised — Amendment to

Notification No. 36/2001-Cus. (N.T.)

[Amend at page 1015 of 71st Edition of Customs Tariff, Vol. 1, 2020-21]

In exercise of the powers conferred by sub-section (2) of section 14 of the

Customs Act, 1962 (52 of 1962), the Central Board of Indirect Taxes & Customs,

being satisfied that it is necessary and expedient so to do, hereby makes the fol-

lowing amendments in the notification of the Government of India in the Minis-

try of Finance (Department of Revenue), No. 36/2001-Customs (N.T.), dated the

3rd August, 2001, published in the Gazette of India, Extraordinary, Part-II, Sec-

tion-3, Sub-section (ii), vide number S.O. 748(E), dated the 3rd August, 2001,

namely :-

In the said notification, for TABLE-1, TABLE-2, and TABLE-3 the follow-

ing Tables shall be substituted, namely :-

“TABLE-1

Sl. Chapter/heading/ Description of goods Tariff value

No. sub-heading/ (US $ Per Metric

tariff item Tonne)

(1) (2) (3) (4)

1 1511 10 00 Crude Palm Oil 614

EXCISE LAW TIMES 1st May 2020 68