Page 101 - ELT_1st June 2020_VOL 372_Part 5th

P. 101

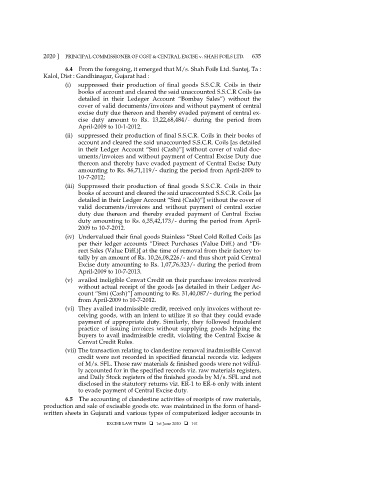

2020 ] PRINCIPAL COMMISSIONER OF CGST & CENTRAL EXCISE v. SHAH FOILS LTD. 635

6.4 From the foregoing, it emerged that M/s. Shah Foils Ltd. Santej, Ta :

Kalol, Dist : Gandhinagar, Gujarat had :

(i) suppressed their production of final goods S.S.C.R. Coils in their

books of account and cleared the said unaccounted S.S.C.R Coils (as

detailed in their Ledeger Account “Bombay Sales”) without the

cover of valid documents/invoices and without payment of central

excise duty due thereon and thereby evaded payment of central ex-

cise duty amount to Rs. 13,22,68,484/- during the period from

April-2009 to 10-1-2012.

(ii) suppressed their production of final S.S.C.R. Coils in their books of

account and cleared the said unaccounted S.S.C.R. Coils [as detailed

in their Ledger Account “Smi (Cash)”] without cover of valid doc-

uments/invoices and without payment of Central Excise Duty due

thereon and thereby have evaded payment of Central Excise Duty

amounting to Rs. 86,71,119/- during the period from April-2009 to

10-7-2012;

(iii) Suppressed their production of final goods S.S.C.R. Coils in their

books of account and cleared the said unaccounted S.S.C.R. Coils [as

detailed in their Ledger Account “Smi (Cash)”] without the cover of

valid documents/invoices and without payment of central excise

duty due thereon and thereby evaded payment of Central Excise

duty amounting to Rs. 6,35,42,173/- during the period from April-

2009 to 10-7-2012.

(iv) Undervalued their final goods Stainless “Steel Cold Rolled Coils [as

per their ledger accounts “Direct Purchases (Value Diff.) and “Di-

rect Sales (Value Diff.)] at the time of removal from their factory to-

tally by an amount of Rs. 10,26,08,226/- and thus short paid Central

Excise duty amounting to Rs. 1,07,76.323/- during the period from

April-2009 to 10-7-2013.

(v) availed ineligible Cenvat Credit on their purchase invoices received

without actual receipt of the goods [as detailed in their Ledger Ac-

count “Smi (Cash)”] amounting to Rs. 31,40,087/- during the period

from April-2009 to 10-7-2012.

(vi) They availed inadmissible credit, received only invoices without re-

ceiving goods, with an intent to utilize it so that they could evade

payment of appropriate duty. Similarly, they followed fraudulent

practice of issuing invoices without supplying goods helping the

buyers to avail inadmissible credit, violating the Central Excise &

Cenvat Credit Rules.

(vii) The transaction relating to clandestine removal inadmissible Cenvat

credit were not recorded in specified financial records viz. ledgers

of M/s. SFL. Those raw materials & finished goods were not wilful-

ly accounted for in the specified records viz. raw materials registers,

and Daily Stock registers of the finished goods by M/s. SFL and not

disclosed in the statutory returns viz. ER-1 to ER-6 only with intent

to evade payment of Central Excise duty.

6.5 The accounting of clandestine activities of receipts of raw materials,

production and sale of excisable goods etc. was maintained in the form of hand-

written sheets in Gujarati and various types of computerized ledger accounts in

EXCISE LAW TIMES 1st June 2020 101