Page 51 - ELT_1st June 2020_VOL 372_Part 5th

P. 51

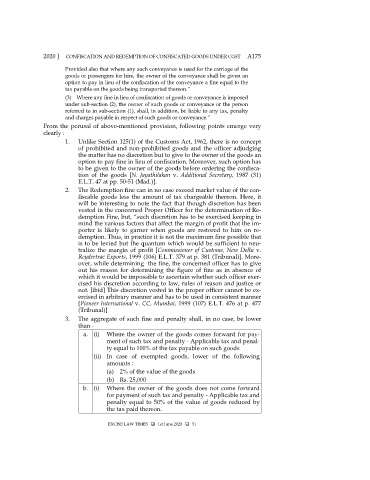

2020 ] CONFISCATION AND REDEMPTION OF CONFISCATED GOODS UNDER CGST A175

Provided also that where any such conveyance is used for the carriage of the

goods or passengers for hire, the owner of the conveyance shall be given an

option to pay in lieu of the confiscation of the conveyance a fine equal to the

tax payable on the goods being transported thereon.”

(3) Where any fine in lieu of confiscation of goods or conveyance is imposed

under sub-section (2), the owner of such goods or conveyance or the person

referred to in sub-section (1), shall, in addition, be liable to any tax, penalty

and charges payable in respect of such goods or conveyance.”

From the perusal of above-mentioned provision, following points emerge very

clearly :

1. Unlike Section 125(1) of the Customs Act, 1962, there is no concept

of prohibited and non-prohibited goods and the officer adjudging

the matter has no discretion but to give to the owner of the goods an

option to pay fine in lieu of confiscation. Moreover, such option has

to be given to the owner of the goods before ordering the confisca-

tion of the goods [N. Jayathilakan v. Additional Secretary, 1987 (31)

E.L.T. 47 at pp. 50-51 (Mad.)].

2. The Redemption fine can in no case exceed market value of the con-

fiscable goods less the amount of tax chargeable thereon. Here, it

will be interesting to note the fact that though discretion has been

vested in the concerned Proper Officer for the determination of Re-

demption Fine, but, “such discretion has to be exercised keeping in

mind the various factors that affect the margin of profit that the im-

porter is likely to garner when goods are restored to him on re-

demption. Thus, in practice it is not the maximum fine possible that

is to be levied but the quantum which would be sufficient to neu-

tralize the margin of profit [Commissioner of Customs, New Delhi v.

Reydertrac Exports, 1999 (106) E.L.T. 379 at p. 381 (Tribunal)]. More-

over, while determining the fine, the concerned officer has to give

out his reason for determining the figure of fine as in absence of

which it would be impossible to ascertain whether such officer exer-

cised his discretion according to law, rules of reason and justice or

not. [ibid] This discretion vested in the proper officer cannot be ex-

ercised in arbitrary manner and has to be used in consistent manner

[Pioneer International v. CC, Mumbai, 1999 (107) E.L.T. 476 at p. 477

(Tribunal)]

3. The aggregate of such fine and penalty shall, in no case, be lower

than -

a. (i) Where the owner of the goods comes forward for pay-

ment of such tax and penalty - Applicable tax and penal-

ty equal to 100% of the tax payable on such goods

(ii) In case of exempted goods, lower of the following

amounts :

(a) 2% of the value of the goods

(b) Rs. 25,000

b. (i) Where the owner of the goods does not come forward

for payment of such tax and penalty - Applicable tax and

penalty equal to 50% of the value of goods reduced by

the tax paid thereon.

EXCISE LAW TIMES 1st June 2020 51