Page 58 - ELT_1st June 2020_VOL 372_Part 5th

P. 58

T22 EXCISE LAW TIMES [ Vol. 372

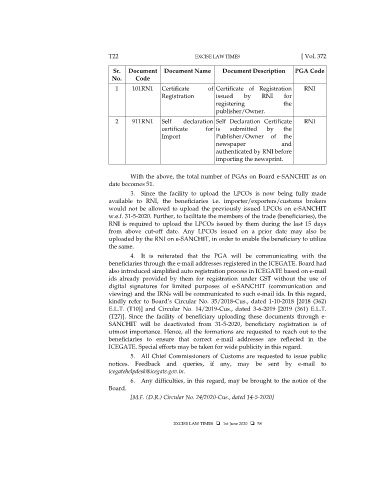

Sr. Document Document Name Document Description PGA Code

No. Code

1 101RN1 Certificate of Certificate of Registration RNI

Registration issued by RNI for

registering the

publisher/Owner.

2 911RN1 Self declaration Self Declaration Certificate RNI

certificate for is submitted by the

Import Publisher/Owner of the

newspaper and

authenticated by RNI before

importing the newsprint.

With the above, the total number of PGAs on Board e-SANCHIT as on

date becomes 51.

3. Since the facility to upload the LPCOs is now being fully made

available to RNI, the beneficiaries i.e. importer/exporters/customs brokers

would not be allowed to upload the previously issued LPCOs on e-SANCHIT

w.e.f. 31-5-2020. Further, to facilitate the members of the trade (beneficiaries), the

RNI is required to upload the LPCOs issued by them during the last 15 days

from above cut-off date. Any LPCOs issued on a prior date may also be

uploaded by the RNI on e-SANCHIT, in order to enable the beneficiary to utilize

the same.

4. It is reiterated that the PGA will be communicating with the

beneficiaries through the e-mail addresses registered in the ICEGATE. Board had

also introduced simplified auto registration process in ICEGATE based on e-mail

ids already provided by them for registration under GST without the use of

digital signatures for limited purposes of e-SANCHIT (communication and

viewing) and the IRNs will be communicated to such e-mail ids. In this regard,

kindly refer to Board’s Circular No. 35/2018-Cus., dated 1-10-2018 [2018 (362)

E.L.T. (T10)] and Circular No. 14/2019-Cus., dated 3-6-2019 [2019 (361) E.L.T.

(T27)]. Since the facility of beneficiary uploading these documents through e-

SANCHIT will be deactivated from 31-5-2020, beneficiary registration is of

utmost importance. Hence, all the formations are requested to reach out to the

beneficiaries to ensure that correct e-mail addresses are reflected in the

ICEGATE. Special efforts may be taken for wide publicity in this regard.

5. All Chief Commissioners of Customs are requested to issue public

notices. Feedback and queries, if any, may be sent by e-mail to

icegatehelpdesk@icegate.gov.in.

6. Any difficulties, in this regard, may be brought to the notice of the

Board.

[M.F. (D.R.) Circular No. 24/2020-Cus., dated 14-5-2020]

EXCISE LAW TIMES 1st June 2020 58