Page 82 - ELT_1st June 2020_VOL 372_Part 5th

P. 82

N84 EXCISE LAW TIMES [ Vol. 372

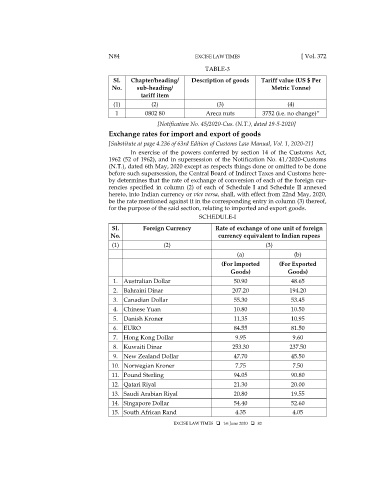

TABLE-3

Sl. Chapter/heading/ Description of goods Tariff value (US $ Per

No. sub-heading/ Metric Tonne)

tariff item

(1) (2) (3) (4)

1 0802 80 Areca nuts 3752 (i.e. no change)”

[Notification No. 45/2020-Cus. (N.T.), dated 19-5-2020]

Exchange rates for import and export of goods

[Substitute at page 4.236 of 63rd Edition of Customs Law Manual, Vol. 1, 2020-21]

In exercise of the powers conferred by section 14 of the Customs Act,

1962 (52 of 1962), and in supersession of the Notification No. 41/2020-Customs

(N.T.), dated 6th May, 2020 except as respects things done or omitted to be done

before such supersession, the Central Board of Indirect Taxes and Customs here-

by determines that the rate of exchange of conversion of each of the foreign cur-

rencies specified in column (2) of each of Schedule I and Schedule II annexed

hereto, into Indian currency or vice versa, shall, with effect from 22nd May, 2020,

be the rate mentioned against it in the corresponding entry in column (3) thereof,

for the purpose of the said section, relating to imported and export goods.

SCHEDULE-I

Sl. Foreign Currency Rate of exchange of one unit of foreign

No. currency equivalent to Indian rupees

(1) (2) (3)

(a) (b)

(For Imported (For Exported

Goods) Goods)

1. Australian Dollar 50.90 48.65

2. Bahraini Dinar 207.20 194.20

3. Canadian Dollar 55.30 53.45

4. Chinese Yuan 10.80 10.50

5. Danish Kroner 11.35 10.95

6. EURO 84.55 81.50

7. Hong Kong Dollar 9.95 9.60

8. Kuwaiti Dinar 253.30 237.50

9. New Zealand Dollar 47.70 45.50

10. Norwegian Kroner 7.75 7.50

11. Pound Sterling 94.05 90.80

12. Qatari Riyal 21.30 20.00

13. Saudi Arabian Riyal 20.80 19.55

14. Singapore Dollar 54.40 52.60

15. South African Rand 4.35 4.05

EXCISE LAW TIMES 1st June 2020 82