Page 228 - ELT_1st July 2020_Vol 373_Part 1

P. 228

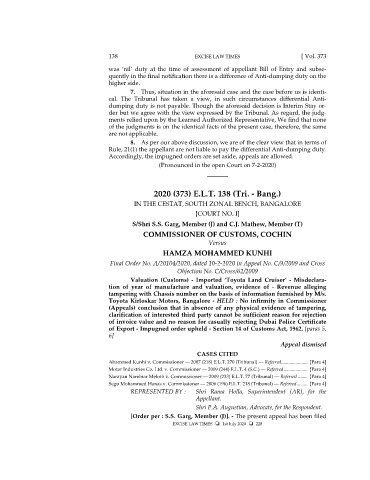

138 EXCISE LAW TIMES [ Vol. 373

was ‘nil’ duty at the time of assessment of appellant Bill of Entry and subse-

quently in the final notification there is a difference of Anti-dumping duty on the

higher side.

7. Thus, situation in the aforesaid case and the case before us is identi-

cal. The Tribunal has taken a view, in such circumstances differential Anti-

dumping duty is not payable. Though the aforesaid decision is Interim Stay or-

der but we agree with the view expressed by the Tribunal. As regard, the judg-

ments relied upon by the Learned Authorized Representative, We find that none

of the judgments is on the identical facts of the present case, therefore, the same

are not applicable.

8. As per our above discussion, we are of the clear view that in terms of

Rule, 21(1) the appellant are not liable to pay the differential Anti-dumping duty.

Accordingly, the impugned orders are set aside, appeals are allowed.

(Pronounced in the open Court on 7-2-2020)

_______

2020 (373) E.L.T. 138 (Tri. - Bang.)

IN THE CESTAT, SOUTH ZONAL BENCH, BANGALORE

[COURT NO. I]

S/Shri S.S. Garg, Member (J) and C.J. Mathew, Member (T)

COMMISSIONER OF CUSTOMS, COCHIN

Versus

HAMZA MOHAMMED KUNHI

Final Order No. A/20104/2020, dated 10-2-2020 in Appeal No. C/9/2009 and Cross

Objection No. C/Cross/62/2009

Valuation (Customs) - Imported ‘Toyota Land Cruiser’ - Misdeclara-

tion of year of manufacture and valuation, evidence of - Revenue alleging

tampering with Chassis number on the basis of information furnished by M/s.

Toyota Kirloskar Motors, Bangalore - HELD : No infirmity in Commissioner

(Appeals) conclusion that in absence of any physical evidence of tampering,

clarification of interested third party cannot be sufficient reason for rejection

of invoice value and no reason for casually rejecting Dubai Police Certificate

of Export - Impugned order upheld - Section 14 of Customs Act, 1962. [paras 5,

6]

Appeal dismised

CASES CITED

Ahammed Kunhi v. Commissioner — 2007 (218) E.L.T. 270 (Tribunal) — Referred ...................... [Para 4]

Motor Industries Co. Ltd. v. Commissioner — 2009 (244) E.L.T. 4 (S.C.) — Referred .................... [Para 4]

Narayan Nambiar Meloth v. Commissioner — 2009 (233) E.L.T. 77 (Tribunal) — Referred ........ [Para 4]

Segu Mohammed Hanas v. Commissioner — 2006 (196) E.L.T. 218 (Tribunal) — Referred ......... [Para 4]

REPRESENTED BY : Shri Rama Holla, Superintendent (AR), for the

Appellant.

Shri P.A. Augustian, Advocate, for the Respondent.

[Order per : S.S. Garg, Member (J)]. - The present appeal has been filed

EXCISE LAW TIMES 1st July 2020 228