Page 232 - ELT_1st July 2020_Vol 373_Part 1

P. 232

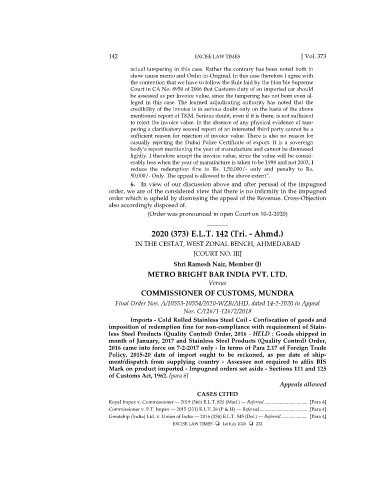

142 EXCISE LAW TIMES [ Vol. 373

actual tampering in this case. Rather the contrary has been noted both in

show cause memo and Order-in-Original. In this case therefore I agree with

the contention that we have to follow the Rule laid by the Hon’ble Supreme

Court in CA No. 8950 of 2006 that Customs duty of an imported car should

be assessed as per Invoice value, since the tampering has not been even al-

leged in this case. The learned adjudicating authority has noted that the

credibility of the invoice is in serious doubt only on the basis of the above

mentioned report of TKM. Serious doubt, even if it is there, is not sufficient

to reject the invoice value. In the absence of any physical evidence of tam-

pering a clarificatory second report of an interested third party cannot be a

sufficient reason for rejection of invoice value. There is also no reason for

casually rejecting the Dubai Police Certificate of export. It is a sovereign

body’s report mentioning the year of manufacture and cannot be dismissed

lightly. I therefore accept the invoice value, since the value will be consid-

erably less when the year of manufacture is taken to be 1998 and not 2003, I

reduce the redemption fine to Rs. 1,50,000/- only and penalty to Rs.

50,000/- Only. The appeal is allowed to the above extent”.

6. In view of our discussion above and after perusal of the impugned

order, we are of the considered view that there is no infirmity in the impugned

order which is upheld by dismissing the appeal of the Revenue. Cross-Objection

also accordingly disposed of.

(Order was pronounced in open Court on 10-2-2020)

_______

2020 (373) E.L.T. 142 (Tri. - Ahmd.)

IN THE CESTAT, WEST ZONAL BENCH, AHMEDABAD

[COURT NO. III]

Shri Ramesh Nair, Member (J)

METRO BRIGHT BAR INDIA PVT. LTD.

Versus

COMMISSIONER OF CUSTOMS, MUNDRA

Final Order Nos. A/10553-10554/2020-WZB/AHD, dated 14-2-2020 in Appeal

Nos. C/12671-12672/2018

Imports - Cold Rolled Stainless Steel Coil - Confiscation of goods and

imposition of redemption fine for non-compliance with requirement of Stain-

less Steel Products (Quality Control) Order, 2016 - HELD : Goods shipped in

month of January, 2017 and Stainless Steel Products (Quality Control) Order,

2016 came into force on 7-2-2017 only - In terms of Para 2.17 of Foreign Trade

Policy, 2015-20 date of import ought to be reckoned, as per date of ship-

ment/dispatch from supplying country - Assessee not required to affix BIS

Mark on product imported - Impugned orders set aside - Sections 111 and 125

of Customs Act, 1962. [para 6]

Appeals allowed

CASES CITED

Royal Impex v. Commissioner — 2019 (366) E.L.T. 820 (Mad.) — Referred .................................... [Para 4]

Commissioner v. P.T. Impex — 2015 (321) E.L.T. 38 (P & H) — Referred ........................................ [Para 4]

Greatship (India) Ltd. v. Union of India — 2016 (338) E.L.T. 545 (Del.) — Referred ...................... [Para 4]

EXCISE LAW TIMES 1st July 2020 232