Page 246 - ELT_15th July 2020_Vol 373_Part 2

P. 246

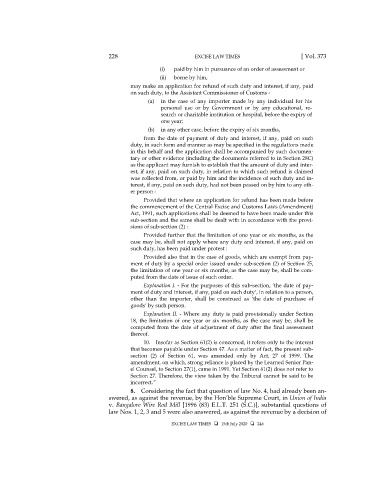

228 EXCISE LAW TIMES [ Vol. 373

(i) paid by him in pursuance of an order of assessment or

(ii) borne by him,

may make an application for refund of such duty and interest, if any, paid

on such duty, to the Assistant Commissioner of Customs -

(a) in the case of any importer made by any individual for his

personal use or by Government or by any educational, re-

search or charitable institution or hospital, before the expiry of

one year;

(b) in any other case, before the expiry of six months,

from the date of payment of duty and interest, if any, paid on such

duty, in such form and manner as may be specified in the regulations made

in this behalf and the application shall be accompanied by such documen-

tary or other evidence (including the documents referred to in Section 28C)

as the applicant may furnish to establish that the amount of duty and inter-

est, if any, paid on such duty, in relation to which such refund is claimed

was collected from, or paid by him and the incidence of such duty and in-

terest, if any, paid on such duty, had not been passed on by him to any oth-

er person :

Provided that where an application for refund has been made before

the commencement of the Central Excise and Customs Laws (Amendment)

Act, 1991, such applications shall be deemed to have been made under this

sub-section and the same shall be dealt with in accordance with the provi-

sions of sub-section (2) :

Provided further that the limitation of one year or six months, as the

case may be, shall not apply where any duty and interest, if any, paid on

such duty, has been paid under protest :

Provided also that in the case of goods, which are exempt from pay-

ment of duty by a special order issued under sub-section (2) of Section 25,

the limitation of one year or six months, as the case may be, shall be com-

puted from the date of issue of such order.

Explanation I. - For the purposes of this sub-section, ‘the date of pay-

ment of duty and interest, if any, paid on such duty’, in relation to a person,

other than the importer, shall be construed as ‘the date of purchase of

goods’ by such person.

Explanation II. - Where any duty is paid provisionally under Section

18, the limitation of one year or six months, as the case may be, shall be

computed from the date of adjustment of duty after the final assessment

thereof.

10. Insofar as Section 61(2) is concerned, it refers only to the interest

that becomes payable under Section 47. As a matter of fact, the present sub-

section (2) of Section 61, was amended only by Act, 27 of 1999. The

amendment, on which, strong reliance is placed by the Learned Senior Pan-

el Counsel, to Section 27(1), came in 1991. Yet Section 61(2) does not refer to

Section 27. Therefore, the view taken by the Tribunal cannot be said to be

incorrect.”

8. Considering the fact that question of law No. 4, had already been an-

swered, as against the revenue, by the Hon’ble Supreme Court, in Union of India

v. Bangalore Wire Rod Mill [1996 (83) E.L.T. 251 (S.C.)], substantial questions of

law Nos. 1, 2, 3 and 5 were also answered, as against the revenue by a decision of

EXCISE LAW TIMES 15th July 2020 246